Policy Papers

Climate Policy

Trevor Tombe on an Evidence-Based Climate Policy for Ontario

Introduction

“Climate change is one of the greatest challenges of our time”, declared G-20 leaders at their 2015 meeting. Most Canadians agree. According to recent research by University of Montreal professor Erick Lachapelle and co-authors, four in five Canadians accept the evidence for climate change, nearly two in three accept human activity contributes, and a majority support strong action to lower emissions.[1] While there is vigorous debate over the appropriate tools, there is a broad consensus across party lines that action is required.

As early as 2008, the former Conservative government under Prime Minister Stephen Harper declared in an ambitious plan entitled Turning the Corner that “climate change is a global problem” and “serious action is required”. The plan called for, among other measures, a price on carbon and regulations to effectively end the construction of coal power plants.[2] More recently, Canada’s Parliament voted overwhelmingly to reaffirm Canada’s commitments under the Paris Agreement to lower our emissions by 30 percent below 2005 levels by 2030. Only one MP voted against the motion.[3]

But Canada’s federation is a decentralized one, and most significant action to date is provincial. Given the unique nature of each province’s economy, geography, demographics, and fiscal and political realities, each has opted for a different approach. Some, such as British Columbia, opted for a market-based revenue-neutral carbon tax system, while others, such as Saskatchewan, has chosen government-led technological initiatives and aggressive renewable power targets. Ontario lies between these two approaches, with a combination of government-led initiatives, such as the coal phase out or large energy efficiency investments, and market-based ones, such as the new cap-and-trade system.

Recently, Canada’s federal government – through the so-called Pan-Canadian Framework on Clean Growth and Climate Change – hopes to begin harmonizing the various provincial actions, and places carbon pricing at the centre. Beginning this year, provinces must have a $10 per tonne price on each tonne of greenhouse gases emitted and this will grow to $50 per tonne by 2022. As provinces adjust their policies, and ratchet up their stringency, governments will face many important and potentially difficult questions.

There is already much controversy. Ontario’s 2018 election campaign will involve rigorous debate over climate policy. It is bound to be a clear differentiator between the different political parties. More broadly, though, all parties – and indeed all Ontarians – will need answers to many important questions. Is Ontario’s current policy ideal? What should be done differently? Should carbon pricing play a role? And if so, what should be done with the revenue? Regardless of the specific answers, the goal should be the same: expand policies that work (and are cost-effective) and scale back or eliminate those that do not (or are not). This policy memo will shed light on these issues, by briefly reviewing current policy, and exploring next steps for Ontario’s next government.

Ontario’s emissions reduction record and targets

Ontario’s climate goals are ambitious: lower emissions 45 percent below 2005 levels by 2030, and over 82 percent by 2050. And in recent years, Ontario has made significant progress. Emissions of greenhouse gases in 2015 totalled just over 166 million tonnes, compared to over 204 million tonnes in 2005. This reduction was, by far, the largest of any province – although the Maritime provinces lowered their emissions by a larger proportion. The trend in more recent years also puts Ontario on track to meet its 2020 objectives (see chart).

Perhaps the single largest contributor to the recent decline was phasing out coal power. In 2015, emissions from power generation was just over 6 million tonnes compared to over 32 million in 2005 – accounting for nearly 70 percent of the total decline. In future years, however, such large reductions will not come from singular decisions such as this. The current emissions profile of Ontario makes this clear.

Perhaps the single largest contributor to the recent decline was phasing out coal power. In 2015, emissions from power generation was just over 6 million tonnes compared to over 32 million in 2005 – accounting for nearly 70 percent of the total decline. In future years, however, such large reductions will not come from singular decisions such as this. The current emissions profile of Ontario makes this clear.

Most of the province’s emissions – approaching 80 percent – are from energy use (see chart). Improved energy efficiency in stationary combustion sources, such as heat for buildings or manufacturing operations, or in road transportation, two-thirds of which is passenger transportation, will be key. This also reveals an important policy challenge: such emissions result from decentralized daily decisions of millions of individuals and businesses. Properly incentivizing individual decisions to lower emissions is the central purpose of putting a price on carbon – and a topic to which we will turn to in detail next.

Most of the province’s emissions – approaching 80 percent – are from energy use (see chart). Improved energy efficiency in stationary combustion sources, such as heat for buildings or manufacturing operations, or in road transportation, two-thirds of which is passenger transportation, will be key. This also reveals an important policy challenge: such emissions result from decentralized daily decisions of millions of individuals and businesses. Properly incentivizing individual decisions to lower emissions is the central purpose of putting a price on carbon – and a topic to which we will turn to in detail next.

Ontario’s current climate policy framework

The main pillars of Ontario’s climate policy are (1) a cap-and-trade system, and (2) various environmental initiatives funded by its proceeds.

‘Cap-and-trade’ is a system where emissions require a permit. The total number of permits is capped at the desired emissions goal, but individual permits can be traded across firms (hence the name). In 2017, there were 142.3 million permits available – equivalent to just over 88 percent of Ontario’s 2016 emissions – and by 2030 this will fall to 88.5 million.[4] This is roughly as broad a coverage as possible, due to difficulties in pricing emissions from certain sources such as waste or agriculture, and the administrative costs of covering very small fuel distributors (i.e., those with sales less than 200 litres per year). In addition to its own permits, Ontario will link its cap-and-trade system with California and Quebec starting January 1, 2018. Firms can use permits from any jurisdiction as an allowance to emit in any other.

How will the cap-and-trade system lower emissions? Two ways. For those emitters that are covered by the system, there is an incentive to lower emissions to avoid having to buy a permit or to gain an opportunity to sell one to another firm. Though it covers large industrial emitters and fuel distributors, households also (implicitly) face the cost of emitting since fuel distributors are charged on the emissions embodied in the fuel, and they pass through the cost to consumers at the pump or through utility bills. While slightly less visible to consumers than an explicit carbon tax, the economics is similar. And both are considered “market-based” approaches, as individual households and businesses make their own decisions over whether and how to lower emissions, not the government.

In addition to functioning as an individual incentive, the government will raise significant revenues from auctioning emissions permits – approximately $1.8 billion per year – and will allocate these funds to GHG reducing activities. This is the other main plank of current Ontario climate policy. Announcements so far include up to $900 million to improve energy efficiency in multi-tenant apartments and social housing units, up to $377 million to establish the “Green Ontario Fund” to subsidize household and business energy efficiency improvements, $400-800 million to improve energy efficiency in schools and hospitals, up to $175 million for low-carbon fuel adoption, up to $277 million to increase the use of electric vehicles, up to $225 million in cycling and walking infrastructure, $290 million for low-carbon trucks and busses, and so on.[5] In the future, the level of revenue raised may increase as carbon prices do, providing more funds for such spending initiatives. But eventually, revenues will decline as the quantity of emissions does.

Table 1 displays a selection of the initiatives. It displays both the total intended funding, and the government’s estimates of the total cost per tonne of emissions avoided. The per-tonne cost of lowering emissions (the “marginal abatement cost”, if you will) is important. This tells us what we had to pay to avoid emitting each tonne of greenhouse gas. And some actions are costlier than others. Estimates include $225 per tonne to help homeowners adopt low-carbon technology, $270 for improved energy efficiency in schools and hospitals, $425 to improve energy efficiency in multi-tenant residential buildings, $100 to increase low-carbon trucks and bus use, and so on.

Table 1 displays a selection of the initiatives. It displays both the total intended funding, and the government’s estimates of the total cost per tonne of emissions avoided. The per-tonne cost of lowering emissions (the “marginal abatement cost”, if you will) is important. This tells us what we had to pay to avoid emitting each tonne of greenhouse gas. And some actions are costlier than others. Estimates include $225 per tonne to help homeowners adopt low-carbon technology, $270 for improved energy efficiency in schools and hospitals, $425 to improve energy efficiency in multi-tenant residential buildings, $100 to increase low-carbon trucks and bus use, and so on.

Before exploring the pros and cons of such spending initiatives, and of the cap-and-trade system in general, a few important points are worth making.

First, it is difficult to estimate the precise average per tonne cost of avoided emissions under the cap-and-trade system, but even a rough estimate provides a useful benchmark. One cannot simply look to the prevailing price of an emissions permit, as there will be many abatement opportunities that cost less. So, consider recent analysis by EnviroEconomics (a consultancy) for the Ontario Government.[6] They estimate the cap-and-trade system may lower Ontario GDP by 0.03 percent in 2020 relative to a no-policy benchmark. They further find emissions in Ontario may decline by 3.8 million tonnes and a further 14.9 million tonnes abated in other jurisdictions as Ontario firms buy permits there. With forecast GDP by 2020 at close to $850 billion (in 2017 dollars), the foregone economic activity is worth roughly $14 per tonne of avoided emissions.[7]

Second, high costs per tonne is not necessarily an indictment of a given policy. To be sure, paying more to lower emissions than one must is not ideal, but depending on the policy there are complementary benefits to consider. Increase cycling infrastructure, for example, may have a variety of costs and benefits independent of climate change and emissions considerations. The government’s estimates of $500 per tonne makes this a poor option to lower emissions, but does not imply such infrastructure is not worthwhile for health, congestion, or other reasons. This memo will not address these complementary benefits of climate policy.

Finally, not all direct interventions have high costs per tonne of GHGs avoided and sometimes seemingly sensible decisions would not be made by individuals even in the presence of a price on carbon. For example, most of us have certain behavioural heuristics or psychological biases that prevent us from taking fully rational decisions in certain situations. The cost of replacing an incandescent light-bulb with a high-efficiency LED, for example, is negative over the life of the new bulb. Yet, some (perhaps many) of us do not do so. There may therefore be scope for targeted ‘nudges’ to help improve decision making. The same may be true in business and industry, where decisions are made by individuals with similar biases. Such initiatives make sense whether or not robust carbon pricing policy exists. These opportunities, however, are the exception not the rule.

With Ontario approaching climate mitigation through a mixture of market-based and government-led approaches, it is worth exploring the pros and cons of each.

The merits of market-based policies

Let us begin with a simple yet powerful observation: there are many ways to lower emissions, and some cost more than others. To lower emissions in the cheapest possible way therefore entails opting for the least-cost ways of lowering emissions first. That is, the goal should be to pick the lowest hanging fruit first before working our way up the tree.

This is easier said than done. There are countless millions of individual decisions made by households and businesses that can affect emissions. Each decision carries costs and benefits. Some emitting activities are incredibly valuable, while others are less so. Central authorities often do not, and cannot, know which options to lower emissions come at the least cost.

This is where carbon pricing comes in. A price that attempts to reasonably capture the cost of environmental damage resulting from emitting a tonne will ensure that households and businesses make decisions knowing the full cost of their actions. The result also tends to be that emissions fall in the least-cost manner possible.

A simple illustration may be helpful. Suppose we emit 10 million tonnes per year and want to cut this in half. Further suppose there are 10 different options available, and each lowers emissions by 1 tonne but at a different cost. Ranking these options from least-costly to most-costly, it is clear that the lowest cost way to reach our emissions reduction goal is with the five lower cost options. Any other combination of five policies will cost more.

If government knew which five options were cheapest, then mandating them would be efficient. But what if government does not know? Broadly speaking, there are two options. First, government could charge $100 per tonne, say, for each tonne emitted. Those with access to options that cost less would rather lower emissions than pay the tax. Thus, the cheapest options are adopted without the government knowing which options those are. Or second, government could require emitters hold permits for each tonne they release. If such permits are scarce and tradable, then firms will bid for them. Firms with low-cost options available to directly lower emissions will not be willing to bid much, while firms with high-cost options would be willing to bid more. This competition for permits will lead to the same outcome has the carbon tax – the cheapest abatement options will be undertaken.

If government knew which five options were cheapest, then mandating them would be efficient. But what if government does not know? Broadly speaking, there are two options. First, government could charge $100 per tonne, say, for each tonne emitted. Those with access to options that cost less would rather lower emissions than pay the tax. Thus, the cheapest options are adopted without the government knowing which options those are. Or second, government could require emitters hold permits for each tonne they release. If such permits are scarce and tradable, then firms will bid for them. Firms with low-cost options available to directly lower emissions will not be willing to bid much, while firms with high-cost options would be willing to bid more. This competition for permits will lead to the same outcome has the carbon tax – the cheapest abatement options will be undertaken.

The merits of market-based approaches to lower emissions goes beyond cost effectiveness. A price on carbon also provides a relatively straightforward benchmark to compare policy across jurisdictions. In a country like Canada, where most policy is provincial, this is an important consideration. Moreover, there may be additional intrinsic value in allowing individual freedom to choose whether and how to lower emissions. This not only leverages decentralized knowledge of relative costs and benefits of different options – which lowers the aggregate cost of meeting any given target – but means pricing emissions and leaving the rest to markets is about as libertarian a climate policy as one could imagine.

The merits of market-based approaches to lower emissions goes beyond cost effectiveness. A price on carbon also provides a relatively straightforward benchmark to compare policy across jurisdictions. In a country like Canada, where most policy is provincial, this is an important consideration. Moreover, there may be additional intrinsic value in allowing individual freedom to choose whether and how to lower emissions. This not only leverages decentralized knowledge of relative costs and benefits of different options – which lowers the aggregate cost of meeting any given target – but means pricing emissions and leaving the rest to markets is about as libertarian a climate policy as one could imagine.

But does putting a price on carbon lower emissions? Yes. If a facility must choose between two machines, where one is less emissions intensive than the other, carbon pricing creates an incentive to select the less emissions intensive machine where it makes sense. If the more efficient machine emits 100 fewer tonnes and costs $2,000 more than the other, it makes sense to select the efficient machine if the carbon price is more than $20 per tonne. For households, there is a similar incentive to install smart thermostats and more energy efficient appliances. And over time, innovation will gradually tilt towards emission reducing technologies because of the demand for such products created by carbon pricing.

The evidence for this, from decades of research, is overwhelming: incentives matter and people respond to prices. When you tax something, the quantity demanded of that good or services tends to fall. Of course, all individuals and businesses differ. They produce different goods, compete in different markets, have different size homes, have higher or lower income, or different number of children. No two people will respond exactly the same way to a price, and some may not respond at all. But there are marginal consumers of energy that will reduce consumption when incented to do so. For relevant evidence, consider research on BC’s carbon tax by UBC economists Werner Antweiler and Sumeet Gulati. They find fuel demand in 2014 would have been 7-percent higher without the tax, and average fuel efficiency would have been 4-percent lower.[8] That is, people consumed less fuel and purchased more fuel-efficient vehicles. Over time, these effects are likely to grow. A comprehensive review of the literature is beyond the scope of this memo, but no serious analyst familiar with it would claim the demand for fuel is completely unresponsive to price.

To be sure, there are a variety of other considerations one should consider. Market-based approaches like carbon pricing is not a magic bullet. But the core merits of market-based approaches are their tendency to lower emissions in the least cost manner possible.

Policy options for Ontario

Even if one favours market-based approaches, two questions remain: Cap-and-trade or carbon taxes? And how should governments use the funds?

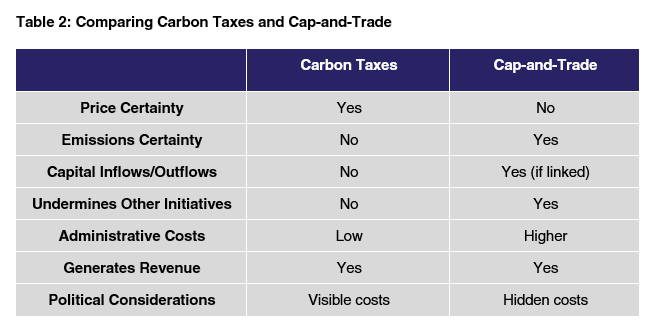

There are a variety of ways in which the two systems may be compared. Carbon taxes fix the price on emissions and lets the market determine the quantity; cap-and-trade fixes the quantity and lets the market determine the price. If one favours certainty over a region’s emissions, this is a point in favour of a cap-and-trade system. If one values the certainty over the price, which tends better enable longer-term business investment decisions, then this is a point in favour of carbon taxes.

But Ontario’s cap-and-trade is linked with others (Quebec and California). So while the total emissions in the system is capped, Ontario’s isn’t since firms have the option of buying permits from elsewhere. This also means funds will flow out of Ontario to other jurisdictions, which is a real economic cost not found in a comparable carbon tax system. And, since the amount of abatement within Ontario is a function of the prevailing permit price, a cap-and-trade system with a low price is less effective at lowering Ontario emissions. This matters. At just over $18 per tonne, the current price in Ontario is less than the carbon tax levels of BC or Alberta, which are at $30 per tonne. In this sense, BC and Alberta have a more stringent policy and Ontario’s emissions would fall more in the near term under a carbon tax system that matched the Federal minimum prices.

For perspective, the same analysis EnviroEconomics analysis cited earlier finds pricing at the federal minimum of $50 per tonne in 2022 will result in over 10 MTs of GHG abatement that year, while the cap-and-trade will result in less than 5. This is due to the lower price currently planned for the cap-and-trade system, which will see gradually rising prices as the number of permits declines. But by 2022, forecasts are for a carbon price of only $22 per tonne. To be sure, future Federal policy may force a price floor in the cap-and-trade systems to keep pace with other provinces. But if not, lower carbon prices in some provinces than others not only means less emissions reductions but risks fraying interprovincial relations and undermining cost-effective national carbon policy.

A cap-and-trade system may also undermine the effectiveness of other emissions reducing policies. Consider the roughly $1 billion allocated to help industry adopt low-carbon technologies in Ontario. The government estimates the cost per tonne of GHG avoided is roughly $30 – which would make this program a very cost-effective option. But is it? That depends. An intervention to lower emissions at a facility covered by the cap-and-trade system will merely lower the demand for permits and cause the carbon price to fall. With this lower price, emissions will not fall by as much elsewhere. The net effect is emissions are unaffected. Whether this occurs or not, however, depends on whether the cap-and-trade carbon price will fall as a result of the intervention. If the price is bound by the minimum floor price, then it will not. But if it is above the floor, then these additional interventions will have zero environmental impact.

A cap-and-trade system may also undermine the effectiveness of other emissions reducing policies. Consider the roughly $1 billion allocated to help industry adopt low-carbon technologies in Ontario. The government estimates the cost per tonne of GHG avoided is roughly $30 – which would make this program a very cost-effective option. But is it? That depends. An intervention to lower emissions at a facility covered by the cap-and-trade system will merely lower the demand for permits and cause the carbon price to fall. With this lower price, emissions will not fall by as much elsewhere. The net effect is emissions are unaffected. Whether this occurs or not, however, depends on whether the cap-and-trade carbon price will fall as a result of the intervention. If the price is bound by the minimum floor price, then it will not. But if it is above the floor, then these additional interventions will have zero environmental impact.

There are other ways in which the systems differ, listed in Table 2 (above), but they are of secondary importance relative to these other considerations. But perhaps the most important point of consider is a broader point: What should the goal of climate policy be?

Price as the primary goal

Canada is small, and each individual province is smaller still. Climate change is a global problem, and requires global emissions decline. The challenge – for international negotiators and governments at all levels – is to allocate emission reduction responsibilities. We could require all lower emissions by the same proportion, or perhaps by the same number of tonnes per person, or require heavy emitting regions reduce more than low emitting regions. The list is long. But to lower emissions at the least possible cost, we should simply require all regions price carbon at the same level. Those regions with many low-cost abatement options will lower emissions by more than regions with few.

To be sure, Canada has a national commitment to lower emissions under the Paris Agreement. How much should each province do to contribute to this national goal, however, is a separate policy question. A price consistent with both Canada’s goal and the global goal to constraint temperature increases avoids having to decide on Ontario’s specific level of emissions and therefore avoids having to decide where to set the cap. And if that price is uniform across Canada, it also ensures we achieve emissions reductions at the lowest cost.

But at what price should we aim for specifically? There is large uncertainty around what price will achieve a particular temperature target, and any statements along these lines are necessarily probabilistic. But the latest IPCC report reviews various estimates, the median estimates in 2016 US dollars of $40 per tonne in 2020, $70 by 2030, $190 by 2050, rising thereafter, could provide a high probability of staying below 2-degree warming.[9]

The International Energy Agency finds similar magnitudes. In their World Energy Outlook 2017, their ‘Sustainable Development Scenario’ features broad international adoption of carbon pricing of $140 per tonne by 2040 (in 2016 US dollars) and is consistent with global climate goals.[10] This suggests that when Canada’s carbon price reaches the $50 per tonne federal minimum in 2022, it should increase by between $5 and $10 per tonne per year thereafter.

To be sure, there are large uncertainties around these numbers, depending on the precise model used and I note them here only to illustrate the potential magnitudes involved. Future research will almost surely necessitate updating such price targets.

But if our focus is price, then provincial carbon taxes – appropriately set, and uniform across provinces – is the appropriate way forward.

Costs of carbon pricing on Ontario households

Regardless of how Ontario prices carbon, whether (and how) household and business costs increase will depend on how governments use the revenue. To many, an increased tax burden is particularly salient and the primary source of opposition to carbon pricing.

The source of any cost increase is one’s energy use. The average Ontario household spends nearly $3,000 per year on fuel for home heating and private transportation. A carbon tax of $10 per tonne will increase natural gas costs by roughly 50 cents per gigajoule, and gasoline by slightly over 2 cents per litre. These are direct costs, and cost the average Ontario household roughly $100 per year for each $10 per tonne carbon price. There are also indirect costs. Trucks use fuel to deliver merchandise to stores, and businesses use fuel to heat their space. Estimating these indirect costs is not trivial, as it requires tracking the input and output flows between sectors, but it is possible. Based on analysis from Statistics Canada’s tax policy simulator (SPSD/M), indirect costs are approximately $40 to $50 per year for each $10 per tonne carbon price.[11] Altogether, the current cap-and-trade system adds between $250 and $300 in costs for the average Ontario household. At the eventual federal minimum price of $50 per tonne, costs for the average household may exceed $700.

Of course, everyone is different and there is a broad dispersion of costs faced by individual households. And higher-income households are burdened less by energy cost increases than low-income households are. Roughly speaking, each $10 per tonne price on carbon increases the average household’s costs by 0.15 percent of income but this ranges from 0.3 percent for lower income households to 0.1 percent for higher income ones.

But carbon pricing need not increase overall tax burdens, and need not transfer revenue from the private sector to the public. Revenue from carbon pricing can be used to lower or eliminate other taxes households and businesses already pay. Lowering personal and corporate income taxes was primarily what British Columbia did with its carbon revenue. And for lower-income households, both BC and Alberta created new direct cash transfers to compensate for higher energy costs. A good rule of thumb for Ontario is that for each $10 per tonne price generates $1 billion in government revenue, providing significant room to lower taxes elsewhere.

Specifically, a $50 per tonne carbon price could yield roughly $5 billion, net of support to large emitters (a topic to which we will turn next), or $3.2 billion more than the current cap-and-trade system with its lower price. Current Ontario policy is to spend the proceeds on environmental initiatives, and such spending would grow if revenue does. An alternative approach would eliminate such spending and return the proceeds to individual Ontario households and businesses directly through lower taxes.

And for Ontario, there are options that are not only revenue-neutral to the government, but revenue neutral (on average) across households across the income distribution. Consider two tax changes: (1) increase the current sales tax credit by 80 percent, and (2) eliminate the Ontario Health Premium. Combined, these changes would cost roughly $5 billion. Roughly speaking, this would make the introduction of carbon pricing roughly neutral from the perspective of average households across the income distribution (see chart below).

This approach will have little to no new administrative costs, and potentially even lower costs as OHP could be fully eliminated. And by boosting the sales tax credit, it avoids the common confusion found in Alberta where “rebates” are perceived as refunds of carbon taxes paid, which would undermine the incentive to lower emissions among those who receive it.

This approach will have little to no new administrative costs, and potentially even lower costs as OHP could be fully eliminated. And by boosting the sales tax credit, it avoids the common confusion found in Alberta where “rebates” are perceived as refunds of carbon taxes paid, which would undermine the incentive to lower emissions among those who receive it.

Of course there are many potential alternative revenue recycling options available, each with pros and cons associated with it. A $50 per tonne carbon tax could allow government to lower personal income taxes by roughly 13 percent, corporate income taxes by roughly one-third, sales taxes by 18 percent, provide fixed transfers of roughly $450 for every person age 18 or older, or various combinations of these options. I illustrate the enhanced sales tax credit and OHP cancellation only as an interesting approach to recycle carbon funds in a revenue-neutral and distributionally-neutral manner. It also has the feature of cancelling one tax with the introduction of another. For vocal opponents of taxation in general, this swap of one tax instrument for another – rather than just adjusting rates on pre-existing taxes – may be particularly appealing.

There are broader macroeconomic reasons to use carbon tax revenue to lower other taxes. Carbon pricing is not enacted in a vacuum. There are a wide variety of pre-existing policy distortions already in place, from regulations to taxes. Even non-environmental policies such as income taxes will have important interaction effects with efforts to reduce emissions. Indeed, many years of research clearly show the costs of such interaction effects are potentially sizable. The revenue raised from carbon pricing can, however, be used to lower distortionary taxes elsewhere. It also provides a valuable opportunity to phase-out relatively less efficient regulations and government-led initiatives to lower greenhouse gas emissions (remember Table 1). This can, potentially, lower the overall costs of lowering emissions.

To be sure, this is not to say that revenue-neutral approach is necessarily optimal. To the extent that projects funded from carbon revenue have benefits that exceed those resulting from lowering taxes, then such spending is defensible. Consider recent research from economists Bev Dahlby and Ergete Ferede, who find large potential gains from lowering either corporate or personal income taxes.[12] They estimate what is called the “marginal cost of public funds”, which can be loosely interpreted as the economic cost of raising $1 of government revenue from a particular tax base. Equivalently, it estimates the gains from using $1 to lower a tax. They find corporate taxes in Ontario have costs of $5.21 per dollar while personal income taxes have costs of $6.76 per dollar. This suggests that projects funded using the incremental carbon revenue must have benefits that are at least $6.76 per dollar spent. Otherwise, the funds were more efficiently allocated to corporate income tax reductions.

In any case, we should separate climate policy discussions from overall tax burdens. Any level of taxation one might desire can be achieved with or without a price on carbon. Using carbon revenue to lower other taxes is always an option.

Competitiveness concerns

Businesses also face higher costs with carbon pricing. And many are unable to pass on those costs to consumers. Either they export to a market abroad or they sell domestically but face competition from imports. If Ontarian firms were forced to raise prices, they may lose business and shut down as consumers shift towards firms not covered by similarly stringent environmental policy. This risks economic activity shifting out of Ontario, with little global environmental benefit.

But the issue of competitiveness is more complex than a simple comparison of carbon prices alone. Consider European car makers, who – at the time of writing – face a carbon price of roughly $10 Euros per tonne ($15). If Ontario increases its carbon price, this does not imply emitting activities will shift out of Ontario and into Europe. After all, emissions are capped in Europe. So any shift in activity would automatically result in prices rising by an amount to keep emissions covered by the system unchanged.

And for regions not covered by a cap-and-trade, leakage concerns can be addressed by ensuring carbon pricing does not appreciably increase average production costs in Ontario. Currently, many permits are allocated for free. And since permits have value, this is equivalent to a subsidy. Under an alternative carbon tax regime, such as in Alberta or in the federal backstop policy, these subsidies also exist. The details of such support are beyond the scope of this brief note, but consider implicitly using proceeds of a carbon tax on large emitters to provide uniform subsidies on each item produced by a firm. Each barrel, each MWh, each tonne of cement, each litre of gasoline, and so on. Properly calibrated, the subsidy ensures average costs of production rise little on average due to carbon pricing. Business with high emissions intensity relative to their peers see cost increases, while those with low emissions intensity see cost decreases. But for all, the incentive to lower emissions is the same.

Concluding thoughts for Ontario’s next government

There are countless challenges to implementing efficient and effective climate policy. But a wide variety of options are available. And while each comes with a cost, most Ontarians are willing to incur at least some to take action on climate change.

Carbon pricing, while politically challenging due to its visibility, is the least-cost means of lowering emissions. And it ensures decisions we make incorporate the full costs, both the private costs we see directly and the broader environmental costs we do not. Concerns around overall tax burden for Ontarians and competitiveness of the province’s industry are not insoluble. Using carbon revenue to provide direct support to industry and to lower (or, indeed, eliminate) pre-existing taxes are always available options.

To be sure, while the evidence finds that pricing should be the backbone of any credible climate policy in Ontario, it is not a magic wand. There are areas where it may not be administratively feasible, and therefore narrow complementary policies should also be on the table. And even where pricing is appropriate, reasonable people will disagree over the appropriate price level and coverage. But whatever path forward future governments choose, they should strive for transparency in costs and benefits, clarity in the goals a policy is trying to achieve, and flexibility as new evidence emerges.

Addressing the global challenge of climate change will be a long and difficult road, but cost effective policy – such as carbon pricing – will help smooth the way. It is up to Ontario’s next government to play its part.

Trevor Tombe, associate professor of economics at the University of Calgary and research fellow at the School of Public Policy