Policy Papers

The 2023 Ontario Budget: Strategic, Economic and Fiscal Policy Considerations

The Ontario government releases its annual budget on Thursday amid economic uncertainty and policy challenges. Brian Lewis, a Munk School Senior Fellow and former Chief Economist for Ontario, outlines key themes that should be addressed.

Executive Summary

While the impact of the COVID-19 pandemic has significantly diminished, these are anything but normal times for government budgets.

There are significant policy demands and risks related to the current economic environment characterized by high price inflation, labour shortages, sharp interest rate increases and slowing growth.

Government finances continue to over-achieve expectations, including Ontario’s fiscal surplus in 2021-22 and possibly another one forthcoming in 2022-23.

It is against this backdrop of economic uncertainty and significant policy demands that the Ontario government has prepared its 2023 budget.

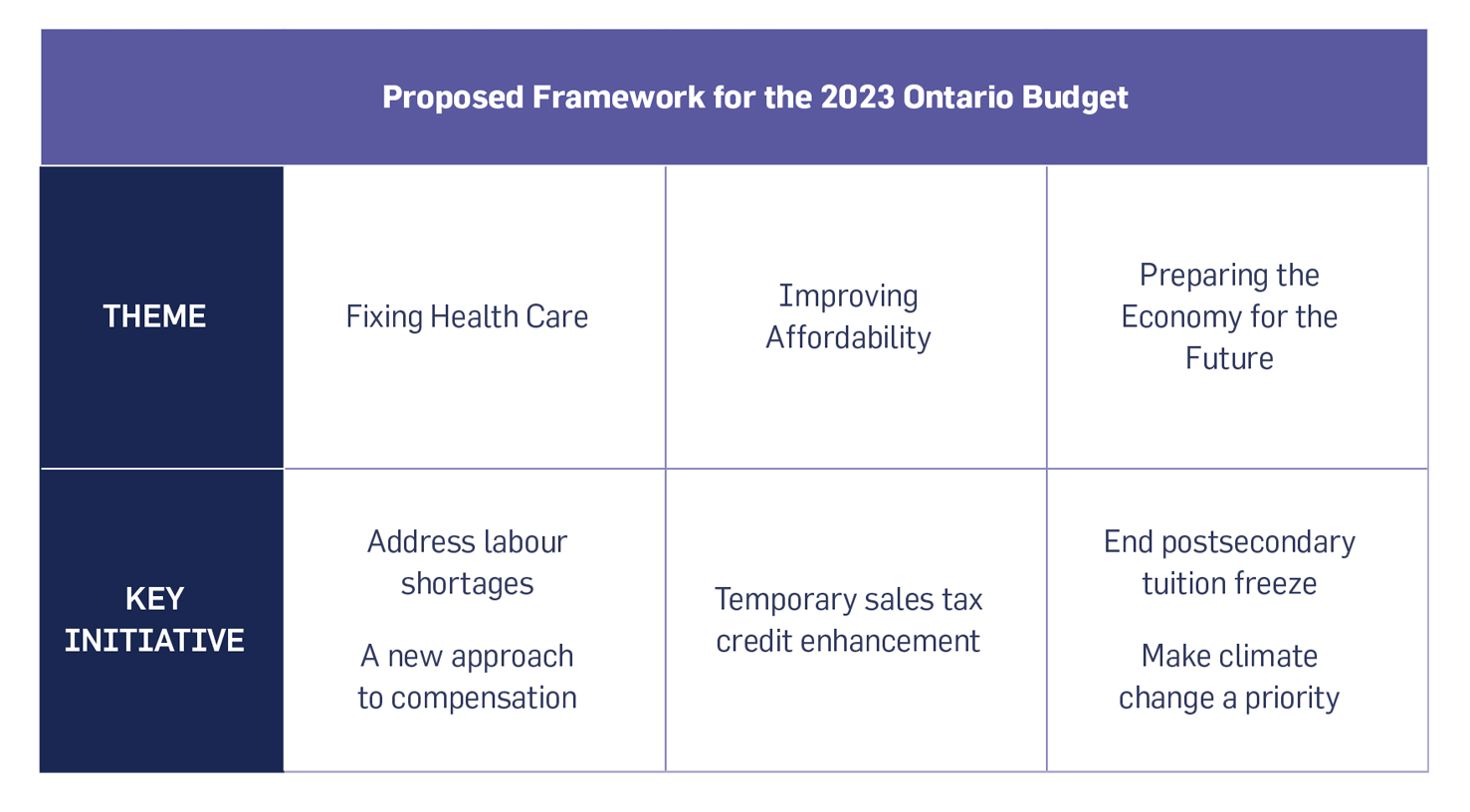

Key themes proposed for the 2023 Ontario Budget in this Ontario 360 policy brief are (1) fixing health care, (2) addressing household affordability, and (3) preparing the economy for the future.

Significant public funding is available to invest in health care, including a modest increase in federal transfers, a substantial increase in the provincial revenue outlook, and potentially drawing upon previously established contingency funds.

A broader agenda for health care requires the government to address the human resources shortage and a new compensation framework to replace Bill 124.

A temporary enhancement of the provincial sales tax credit would provide timely support targeted to those most heavily impacted by rising consumer prices.

The government should add to its suite of policies supporting future economic growth with a particular focus on postsecondary education and climate change.

Introduction

Ontario Minister of Finance Peter Bethlenfalvy carried out the usual pre-Budget consultations earlier this year to support the preparation of the 2023 Ontario Budget. These included in-person sessions held across the province for the first time since 2020.

In-person pre-Budget consultation sessions are but one of the many welcome signs of life – and government budget processes – returning to normal as the impact of the COVID-19 pandemic diminishes. Nevertheless, these are anything but normal times for government budgets.

The COVID-19 pandemic lingers on and will leave a permanent legacy on our society’s health, social, political, and economic fabric.

Geopolitical risks remain elevated due to the war in Ukraine and heightened tensions broadly.

The economic environment is extraordinary compared to anything in recent history, characterized by high consumer price inflation, labour shortages and sharp interest rate increases. Also, economic growth has been slowing and is expected to be modest over the next two years including the risk of an economic recession. In addition, long-standing economic challenges driven by an aging population and climate change are becoming more immediate.

Public finances are also in a unique position, with governments across Canada significantly over-achieving on their fiscal targets and emerging from the past few years with much lower debt burdens than could have reasonably been expected. For example, Ontario ended up with a modest fiscal surplus during the 2021-22 fiscal year, the first year since 2007-08 the province balanced the books. Moreover, the fiscal outlook for 2022-23 has significantly improved since the 2022 Budget was delivered, and this year could also end with a budgetary surplus.

Against this complex backdrop, this Ontario 360 policy brief offers a few words of advice on strategic, economic, and fiscal policy on the 2023 Ontario Budget to be delivered on March 23.

Economic Situation and Outlook

Summary

- The economy is performing at a very high level of output.

- Labour shortages have arisen primarily due to strong economic demand.

- Consumer Price Inflation is trending quickly downwards to normal levels.

- The pace of economic growth has been slowing.

- Modest economic growth is widely projected for 2023, with a slight chance of a very mild recession.

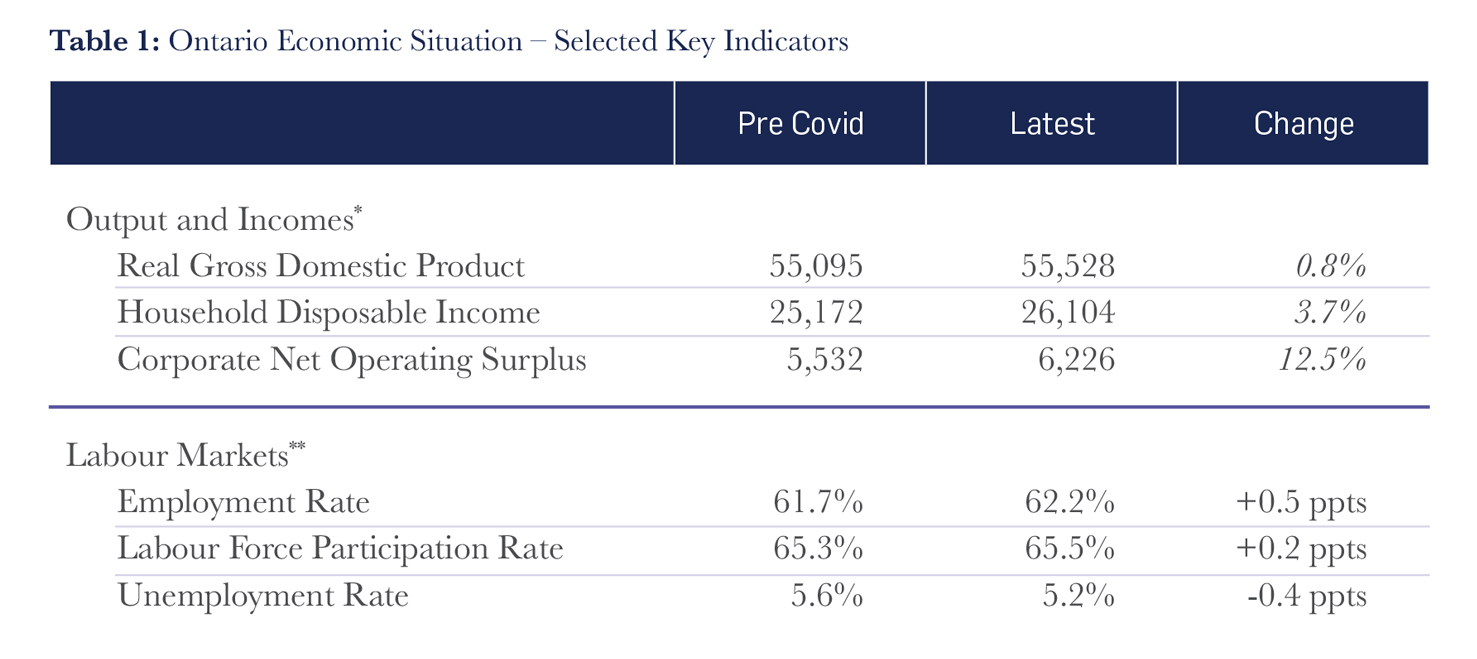

The provincial economy is currently performing at a very high level of output. The commonly applied measure of aggregate economic output – real Gross Domestic Product Per Capita – in the third (July to September) quarter of 2022 was 0.8% above its pre-COVID level. Household disposable incomes rose, and the corporate net operating surpluses were up sharply compared to pre-COVID levels. Labour markets are tight, with employment, labour force participation and unemployment rates all comparing favourably to pre-COVID levels. The higher employment and participation rates are particularly notable given long-term trends downward in these due to the aging population.

* All figures are real ($2012) per capita. Author calculations based on 2022Q3 Ontario Economic Accounts and Statistics Canada Consumer Price Index data. Pre-COVID levels were those in 2019Q4.

** Statistics Canada Labour Force Survey, January 2023. Pre-COVID levels were those in February 2020.

High levels of output and employment have resulted in some associated challenges, notably labour shortages and heightened price inflation.

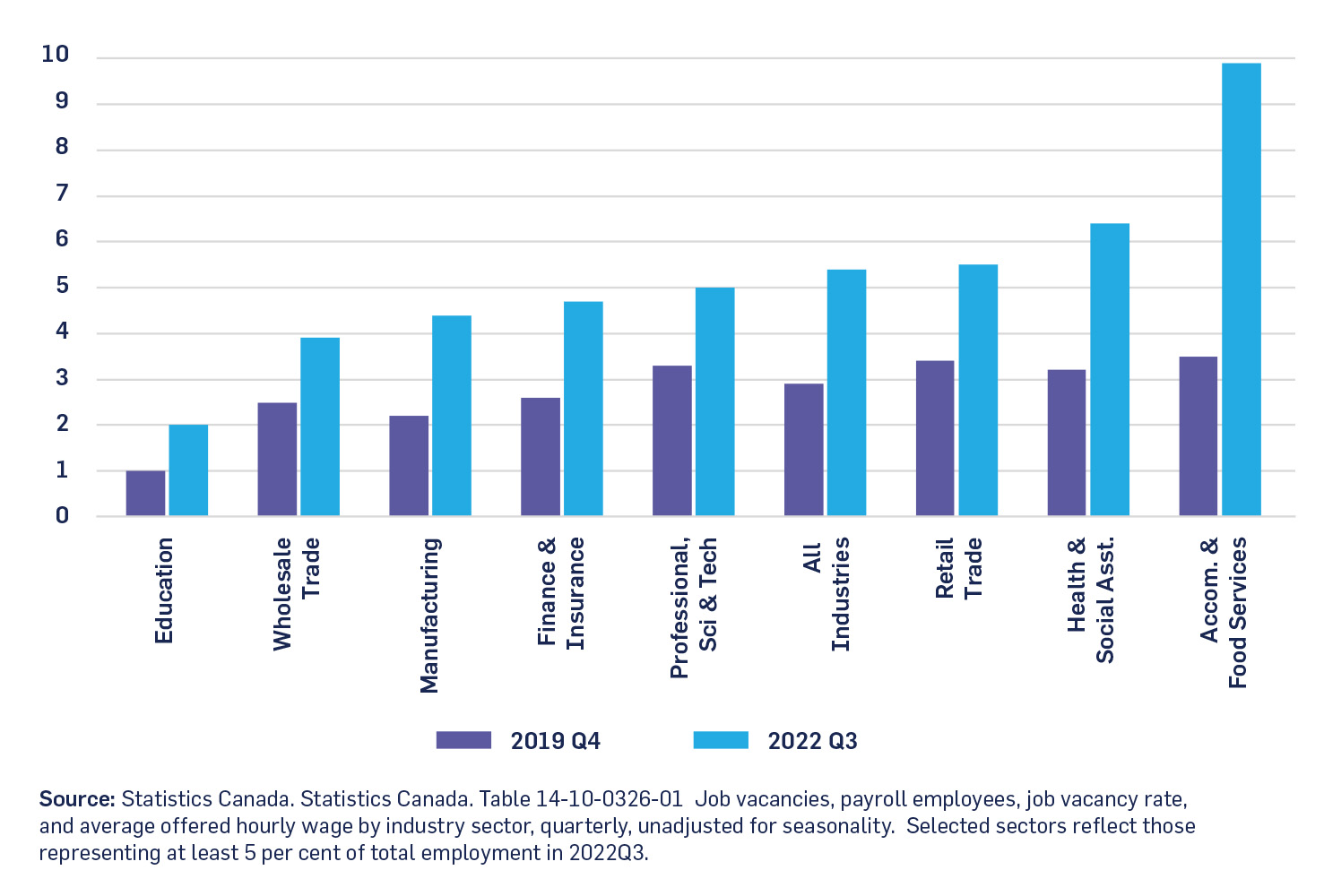

Overall, job vacancies in 2022 were nearly double their pre-COVID norms. Vacancies also vary widely across economic sectors. They are particularly elevated in accommodation and food services. Relatively large employment industries with higher-than-average job vacancies include construction, health care & social assistance and retail trade.

Figure 1: Heighted Job Vacancy Rates

Job vacancies have become a key challenge for businesses and economic growth. For example, according to the Ontario Chamber of Commerce, “labour shortages are directly impacting most employers and 87 percent of large businesses.”[1] Future labour shortages have been predicted for many years across most advanced economies due to the aging population and slowing growth in labour supply. However, high labour force participation and employment rates indicate that high worker demand is the critical factor driving current labour shortages.[2]

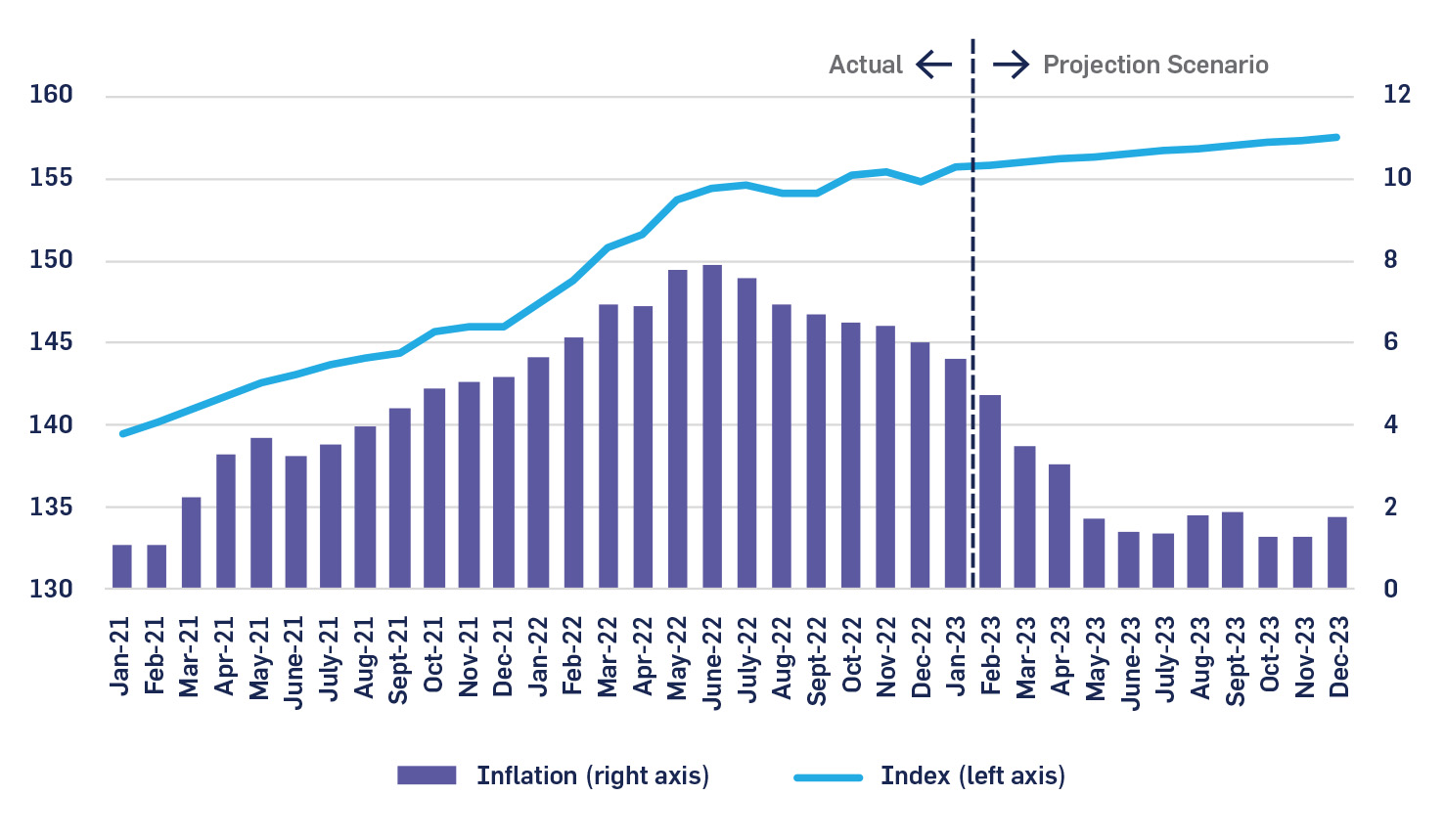

Consumer Price Index (CPI) inflation in Ontario was 7.9 per cent year-over-year in June 2022, the largest increase since February 1983. Recent CPI inflation experience contrasts sharply with the pace of around 2 per cent standard over the past 30 years. Higher prices reduce household purchasing power and the volume of goods and services they consume, reducing the standard of living. Furthermore, when inflation is high, consumers, businesses and investors are increasingly uncertain about their future costs, which is detrimental to investment, consumer spending and economic growth.

CPI inflation has been moderating recently, bringing the year-over-year inflation rate down to 5.6% in January 2023. While this moderation is good news, concerns arise from underlying components of the index. For example, food price inflation – which are items that would have a relatively more significant impact on low-income households – was relatively high at 10.1%.

While the path forward for the CPI index is subject to considerable uncertainty, continuing to increase at its relatively moderate pace since October would result in year-over-year CPI inflation coming down rapidly over the next few months to below 2% over the second half of the year.

Figure 2: Ontario CPI Index and Inflation Scenario

The pace of economic growth has been moderating. The province reported a modest 0.4% gain in real Gross Domestic Product during the July to September quarter of 2022[3], continuing the slowing pace of real GDP growth over the past year from 1.7 per cent in 2021Q4, 1.0 per cent in 2022Q1 and 0.9 per cent in 2022Q2. The government’s most recent financial update includes the annual pace of 2022 real GDP growth[4] of 3.7 per cent which implies a further slowing of growth – essentially zero – in the final quarter of calendar 2022. This pace of growth would be consistent with the Canada-wide results for 202Q4 recently released by Statistics Canada[5]. This slowing growth pace, which is common across peer jurisdictions, is natural at this stage of an economic cycle with minimal economic capacity available.

The pace of economic growth has been moderating. The province reported a modest 0.4% gain in real Gross Domestic Product during the July to September quarter of 2022[3], continuing the slowing pace of real GDP growth over the past year from 1.7 per cent in 2021Q4, 1.0 per cent in 2022Q1 and 0.9 per cent in 2022Q2. The government’s most recent financial update includes the annual pace of 2022 real GDP growth[4] of 3.7 per cent which implies a further slowing of growth – essentially zero – in the final quarter of calendar 2022. This pace of growth would be consistent with the Canada-wide results for 202Q4 recently released by Statistics Canada[5]. This slowing growth pace, which is common across peer jurisdictions, is natural at this stage of an economic cycle with minimal economic capacity available.

Private sector economic forecasts predict a very slow pace of real GDP growth over the next two years, reflecting an economy operating at full capacity, moderating global economic growth and recent sharp increases in interest rates. For example, the latest forecast produced by the University of Toronto Policy and Economic Analysis Program projects Ontario’s real GDP to advance at a very modest pace of 0.7 per cent in 2023 and 1.5 per cent in 2024, following growth of 5.2 per cent in 2021 and 3.8 per cent in 2022.

This slowing growth could potentially include two consecutive quarters of a decline in real GDP, meeting the commonly accepted definition of an economic recession.

The government should respect, but not fear, a potential economic recession. Current private sector forecasts imply a very mild downturn, not necessarily a recession. For example, the recent University of Toronto Policy and Economic Analysis Program forecast projects a one-quarter decline in Ontario’s real GDP of 0.3 per cent in 2023Q2. Moreover, there are many reasons to believe any economic downturn would likely be very mild. For example, labour shortages discourage employers from laying off workers, and the unemployment rate is unlikely to reach anything close to what occurred in past major economic recessions. Furthermore, businesses and household balance sheets are solid, allowing them to stay solvent and support spending in the face of diminishing sales or job prospects.

A Proposed Strategy for the 2023 Budget

The most effective government budgets are those guided by a coherent strategy that drives priorities and policy for the forthcoming year. Therefore, three themes are proposed for the 2023 Ontario Budget reflecting the current context and clearest policy demands: fixing health care, improving affordability and preparing the economy for the future.

Fixing health care is a high priority among the people of the province. This critically important sector is widely perceived to be in crisis. Now is the time for bold action on health care to address both the short-term challenges and take steps towards ensuring long-term sustainability and success. There is new federal funding available, a significant improvement in the province’s revenue outlook, and possibly some contingency funds to draw upon in order to make incremental public investments in the province’s health care system.[6]

Does the province’s fiscal framework reflect sufficient funding for the current health care sector? The Financial Accountability Office of Ontario (FAO) recently projected that “the Province has allocated $12.5 billion in excess funds to support existing programs and announced commitments over the three-year period.”[7] While the FAO is critical of the fact that sector-by-sector allocations are not sufficient to meet projected program expenses, the report also notes that there are far larger amounts on available in contingency funds. These relatively large contingency funds indicate the prudence reflected in the government’s finances and suggest that the current programs are fully funded, even if this is not entirely transparent.

New federal health care funding is a welcome development for the provinces and territories, but the amount is far from overwhelming. Although $46.2 billion in federal funding sounds like a lot of money, it is not in the context of provincial health care expenditure pressures. Considering that this is a cumulative amount calculated over ten years and compared to the province’s projected health care sector expense, this new federal funding is estimated to add less than 2% to Ontario’s projected health care expenditures.[8]

If federal funding alone is insufficient to enable major, new investments in health care, a burgeoning revenue outlook and some unallocated contingency funds are likely more than enough. If they are not, the government could consider raising taxes to pay for fixing health care. Ontarians would respect the strong leadership and be satisfied that it is worthwhile if the health care system’s structural challenges are addressed. At the same time, the federal government could be challenged to lower its taxes to reflect its diminishing contribution to this most critical use of tax dollars, essentially reverse engineering a tax point transfer to the provinces.

The most critical challenge in the health care sector is human resources. Practical measures have been announced, including new funding for postsecondary students who enrol in priority programs such as Health Human Resources. The federal government has also allocated $1.7 billion over the next ten years, but details on how this will work still need to be provided. A recent report by Ontario’s Financial Accountability Office (FAO) indicates the severity of the human resources challenges: “Even with government measures to increase the supply of nurses and PSWs, by 2027-28, the FAO projects a shortfall of 33,000 nurses and PSWs. These nurse and PSW shortages will jeopardize Ontario’s ability to sustain current programs and meet program expansion commitments.”[9]

More human resources are clearly needed, and that requires a policy on compensation that ensures the province is competitive in terms of the wages offered. Otherwise, Ontario risks losing valuable health care workers to retirement and other jurisdictions. As well, the recent steps to enhance private health care service delivery will involve new demands for health-care professionals across the province.

A new framework for broader public sector compensation is needed because the situation has changed dramatically since the government introduced and subsequently passed Bill 124, the Protecting a Sustainable Public Sector for Future Generations Act, in 2019. Public services in general, and especially health care services, have been very heavily impacted by COVID-19. The cost of living is rising much more rapidly than was expected in 2019. There are significantly higher job vacancies in health care. The provincial financial situation is much stronger. The current context calls for a new approach to compensation and a voluntary exit from Bill 124. That would also have some pragmatic appeal given the recent Ontario Supreme Court ruling that deemed it unconstitutional. A new framework that reflects these various developments can therefore represent something of a win-win for health-care workers and the government’s own policy priorities.

Addressing the challenges in health care will require bold action. However, it also provides an opportunity for the government to explore options to overhaul the entire system so that it provides better outcomes more efficiently in the future. Canada currently devotes a relatively higher proportion of GDP to health care than many peer nations without generating correspondingly better outcomes. The country can do better. The good news is that the Ontario government has the fiscal capacity to pursue such an agenda of reform and improvement.

People will be looking to the government to improve affordability in response to the rising cost of living. However, doing so is challenging because much of this is beyond the control or influence of any provincial government. For example, the sharp increases in the cost of basic groceries concern many Ontarians, especially low-income households, but basic groceries are not subject to any direct provincial taxes that could be reduced.

First of all, and most importantly, the government should take full credit for the many things done to improve affordability. Examples include eliminating the cap-and-trade program, electricity price relief, lower gasoline taxes, tax credits for low-income individuals, and childcare benefits. The government might consider adding them up to demonstrate what they mean for a typical or example household. Finally, it is important to recognize that all of these have come with a high cost to the province’s finances.

Secondly, if the government feels the need to do more on affordability – and that feeling is probably irresistible in the context of delivering the 2023 Ontario Budget – a few principles are suggested to guide new policy. Make new affordability measures tangible, visible, timely, targeted and (most importantly) temporary. High consumer price inflation rates will almost certainly ease quickly, calling for temporary rather than permanent policy responses. CPI inflation may also be significantly lower very soon, so new measures should be implemented quickly.

Some things that meet these criteria would be the recently announced continuation of the lower provincial gasoline and fuel taxes and ongoing electricity price relief. At the same time, building a clear exit path from these measures is recommended, for example, a commitment to ending the gasoline tax reduction when pump prices remain below a threshold value and to very gradually ease the electricity price relief that is estimated to cost a whopping $6.7 billion in 2023-24.[10]

Broad-based tax relief, such as reducing the provincial Harmonized Sales Tax or Personal Income Tax, is not advised. The benefits of such policy moves would not reach the people most in need. Moreover, it would probably only take effect once inflation rates have reached normal levels. Instead, a temporary enhancement to the Ontario Sales Tax Credit – focused on low to middle-income tax filers – would be an effective use of financial resources and provide visible and timely assistance to those most in need.

The government has taken significant actions to improve housing affordability, including those reflected in the More Homes Built Faster Act of 2022. Given the extensive measures taken to date, it is advised to continue monitoring developments and recalibrate policy in the future if the ambitious targets outlined by the government are not on track to be met.

Continue to focus on policy that will prepare Ontario for the economy for the future. Good governance includes good long-term thinking. This early point in the government’s new mandate is the best time to do things to enhance the province’s long-term prosperity. It is also an opportunity for policies that government members would look back upon with pride in the future when they deliver results.

The province is starting from a solid base regarding strong economic fundamentals. A succession of Ontario and federal governments have built a province with solid and reliable institutions, a highly skilled labour force, strong links to global markets and a diverse sectoral composition with notable areas of strength.

The government’s economic growth narrative has been consistent across recent fiscal updates, including key areas such as skilled trades, electric vehicle production, critical minerals, infrastructure investments, reducing business costs, cutting red tape and attracting business investment. These will likely be featured again in the 2023 Ontario Budget. These are all credible policies for promoting future economic growth. However, a few significant gaps in the government’s approach to economic growth merit attention, notably postsecondary education and climate change.

The essential factor Ontario can strengthen to drive future economic growth is advancing labour force skills. The critical importance of this is confirmed by a wide variety of business surveys and the Organization for Economic Co-operation and Development, which notes that “skills are the key to shaping a better future and central to the capacity of countries and people to thrive in an increasingly interconnected and rapidly changing world.”[11]

The province has implemented a broad range of policies to increase the supply and employment of skilled tradespeople. However, postsecondary education is where the province has a significant gap in its approach to labour force skills. The freeze on tuition for Ontario’s publicly assisted colleges and universities has been in place since 2018-19 and has recently been extended by the province for an additional academic year to 2022–23. There is a good case to let it expire.

While the tuition freeze is improving the affordability of postsecondary education marginally for domestic students, these savings are not critical to the ability of most of them to enrol in a college or university program. Focusing financial assistance instead on the students in greatest need of support would lower the economic cost of imposing lower tuition fees on the entire postsecondary education system. In addition, better results can be pursued through Strategic Mandate Agreements, which are a far more impactful policy tool than broad-based fee restrictions. Ultimately, students and taxpayers want excellence from the postsecondary education system. Continuing the tuition freeze would be a big step toward mediocrity.

Climate change is also a significant gap in the province’s environmental policy and economic growth approach. The impacts of climate change are increasingly becoming a near and present problem, and people are increasingly looking for governments to provide leadership in this area. A strengthening focus on this is also called for arising from the recent Inflation Reduction Act in the United States, which is primarily a wide-ranging framework for climate policy and industrial development.

There needs to be more confidence in Ontario’s Plan to Reduce Greenhouse Gas Emissions. In 2019 the Auditor General of Ontario concluded that “the emission-reduction estimates in the Plan are not based on sound evidence or sufficient detail. In its current early state, the Plan is not likely to achieve its proposed emission-reduction target.”[12] Two years later, in a follow-up report, the Auditor General indicated that “the Ministry has initiated some work to update its climate change plan to be based on sound evidence,” but that only 27% of its previous recommendations had been implemented, 18% were in progress and half of the recommendations had yet to make any progress.[13]

There are too few signs of progress on this front. There is a huge need to prepare the provincial economy for a lower greenhouse gas emissions future. The only references to climate change in the 2022 Ontario Budget and 2022 Ontario Economic Outlook and Fiscal Review were regarding the popular Green Bond program and a few infrastructure investment programs. Significant new investments by the private sector in electric vehicle-related manufacturing are encouraging, but a lot more could be done.

It would be beneficial for the government to articulate a clear vision toward long-term economic growth for the province. There is a legislative requirement[14] to deliver a long-range assessment of Ontario’s economic and fiscal environment within two years after the most recent general election, which is June 2, 2024. The government is encouraged to not only deliver this assessment but to go further, utilizing it as a basis for developing a comprehensive economic strategy for the province and as a framework for economic policy over the next several years.

Fiscal Outlook and Policy

Summary

- 2022-23 deficit lower and could end in a budgetary surplus.

- Significant increase in the outlook for provincial revenues.

- Continue the practice of prudent fiscal forecasting.

- Reaffirm and strengthen commitments to budgetary transparency.

The 2023 Budget is being delivered in the context of significant continued improvements in the province’s finances.

The 2023 Ontario Third Quarter Finances reduced the province’s 2022–23 deficit projection to $6.5 billion, significantly lower than previous forecasts in the 2022 Ontario Budget ($19.8 billion) and 2022 Economic Outlook and Fiscal Review ($12.9 billion). The improved deficit outlook is due to a substantial increase in provincial revenues (up $16.6 billion from the 2022 Ontario Budget) and partially offset by higher expenses (up $3.4 billion) that are primarily one-time in nature related to recognizing costs associated with ongoing land and land-related claims with Indigenous communities.

The 2022-23 Third Quarter Finances deficit projection is prudent. It maintains a fiscal reserve of $1 billion and includes an expense contingency fund of $1.7 billion, which are both very likely to contribute to a lower deficit at year-end. Furthermore, the update did not include any expectation for expenses coming in – as they usually do – below Ministry allocations. Yet the Financial Accountability Office of Ontario reports that over the first three quarters of 2022-23, the province spent $6.4 billion less than expected. There is no guarantee this amount will emerge as savings when the books on the year are closed, but it is a typical result for expenses at year-end to be 1 to 2 per cent lower than allocations. For example, program expense in 2021-22 was $3.5 billion (2.0 per cent) lower than estimated in the April 2022 Ontario Budget.

There is also the potential for changes in reported revenues from interim estimates. These tend to improve between 1 to 2 percent when the books are finalized, and revisions have been much higher in recent years. For example, in 2021-22, revenues were $11.5 billion (6 per cent) higher than expected at the time of the 2022 Ontario Budget. While the experience of the last few years has been anomalous due to factors related to the COVID-19 pandemic, and a comparable revenue windfall is very unlikely, the risks are heavily weighted towards some combination of lower-than-projected expense and higher-than-projected revenues reducing the province’s deficit when the books are closed for 2022-23.

Given the prudent approach apparent in the 2022-23 Ontario Third Quarter Finances, the deficit will likely be much lower, and it is possible the province will attain a second consecutive budgetary surplus. This scenario is supported by the estimates of the Financial Accountability Office of Ontario that has projected a budget deficit of $2.5 billion in 2022-23, based on a revenue estimate that was $7.9 billion lower than revealed by the government in the 2022-23 Ontario Third Quarter Finances one week later.

Higher 2022-23 revenues will carry forward to some degree into the forecast period. Precisely how much of the $16.6 billion increase since the 2022 Ontario Budget is uncertain. Some of the increase in 2022-23 revenues above the 2022 Ontario Budget forecast, likely in the range of 25 to 50 per cent, will be assumed to be one-time, with the rest carrying forward into the forecast. Weaker economic growth forecasts will dampen revenue growth projections, but this will only offset a small proportion of the impact of the much higher 2023-23 starting point for a “policy status quo” revenue forecast over the fiscal planning period.

The improving revenue outlook provides the government with opportunities for some combination of investing in the health care system, launching new pro-growth initiatives, enacting tax cuts, or lowering projected deficits. However, broad-based and sizeable expenditure increases or tax cuts are not advised. Doing so would result in renewed upward pressure on prices, undermining the Bank of Canada’s efforts to bring down inflation and potentially requiring further interest rate increases. Instead, the government is advised to dedicate scarce resources to investing in health care and a few signature initiatves, applying any remaining increase in the revenue forecast to improving the projected fiscal balance.

It is also appropriate for the government to continue to be prudent in its fiscal forecasting and not be swayed into optimistic approaches by the last few years of over-achievement. Prudence will serve the province’s finances well given the recent turbulence in the US banking sector and uncertainty related to the geopolitical environment and economic outlook.

The revenue bonanza of the past few years will not continue. The ancillary effect of government COVID-19 programs on taxation revenues will wane quickly as the programs are ended. There are emerging downside revenue risks, such as the impacts of the housing market slowdown on Harmonized Sales Tax and Land Transfer Tax revenues and those related to declining financial asset values on Corporate Income Tax revenues, that are all quite real and essentially impossible to quantify with precision.

Prudence is also appropriate for provincial expenditure plans. The recent high inflation rates will result in a broad range of expenditure pressures, including those related to CPI-indexed programs, supply costs and wage increases. The timing of the expense pressures related to high inflation will occur with a longer time lag than the far more immediate impact on households, businesses, and provincial taxation revenues. Some of these expense pressures are difficult to anticipate with any accuracy. It is recommended that the government include appropriately prudent contingency funds as a buffer against the uncertain effects of recent elevated price inflation on future expenditures.

It would be reassuring for the province to reaffirm and strengthen its commitment to budgetary transparency and accountability. Ontario is a leader on these issues, with the current and previous governments having legislated many best practices.

The government has recently announced a Budget date of March 23. Delivering the Budget before the end of the fiscal year is a best practice. It also indicates that the government will not be exercising the opportunity in the legislation to delay the Budget immediately following a provincial election.[15] By delivering the Budget before March 31, the government is restoring some integrity that was compromised last year when the 2022 Budget was delayed – and corresponding legislation amended, avoiding a fine on both the Finance Minister and Premier – for reasons that were not very persuasive.

There are opportunities for improving transparency in a few areas, such as more detailed disclosure of the impact of new spending and non-tax revenue initiatives. For example, the Ontario Budget always includes incredible detail on the financial impact of tax policy changes. However, it would be helpful to replicate this level of disclosure for other, usually much larger, new expenditures and non-tax revenue initiatives. For example, the 2022 Budget did not provide a detailed year-by-year disclosure of the financial impact of ending licence plate renewal fees. Likewise, the financial impact of new expenditures in a comprehensive and detailed manner was not disclosed.

A final word on expense management within the government itself. The provincial government has reported progress in reducing red tape for businesses, workers, and citizens. It should apply that lens to public services as well. In recent years, there has been an inexorable growth in internal documentation and reporting, essentially internal red tape, introduced with the goal being to strengthen accountability and control. However, the growth in documentation also reduces productivity by diverting resources from delivering services. For example, the Ontario Medical Association asks its doctors to “spend more time with patients doing the things that only doctors can do and less time on paperwork or other tasks.” Who thinks that is a bad idea? The government should do the same.

Brian Lewis is a senior fellow and lecturer at the Munk School of Global Affairs and Public Policy at the University of Toronto. He is a former chief economist at the Province of Ontario.

NOTES

[1] Ontario Chamber of Commerce, Ontario Economic Report, February 2023.

[2] See Mikal Skuterud, “Canada’s worker ‘shortage’ is an illusion, and bringing in cheap labour doesn’t help.” Globe And Mail. February 23, 2023.

[3] Ontario Ministry of Finance. Ontario Economic Accounts: 2022 Third Quarter. January 2023.

[4] Ontario Ministry of Finance, 2023-23 Third Quarter Finances, February 2023.

[5] Statistics Canada. Gross Domestic Product, Income and Expenditure, Fourth Quarter 2022. February 2023.

[6] More details are in the “Fiscal Outlook and Policy” section below.

[7] Financial Accountability Office of Ontario. Economic and Budget Outlook. February 2023. Page 1.

[8] Author calculations.

[9] Financial Accountability Office of Ontario. Ontario Health Sector: Spending Plan Review. March 2023. Page 1.

[10] Financial Accountability Office of Ontario. Ontario’s Energy and Electricity Subsidy Programs. February 2022.

[11] Organization for Economic Co-operation and Development. OECD Skills Strategy. February 2023

[12] Auditor General of Ontario. 2019 Annual Report.

[13] Auditor General of Ontario. 2021 Annual Report.

[14] Fiscal Sustainability, Transparency and Accountability Act, 2019, Section 12: Long-range economic and fiscal environment assessment.

[15] Fiscal Sustainability, Transparency and Accountability Act, 2019, Section 4(2) “ Exception, recent general election”.