Policy Papers

ON360 Transition Briefings 2022 – The Drive to Survive and to Grow: How Ontario can succeed in the EV era

The automotive manufacturing industry is transforming into an electric vehicle ecosystem. While many opportunities exist to thrive and grow, there are issues that need to be acknowledged in order for this sector to continue to remain a vital part of the provincial economy.

Issue

The automotive manufacturing industry is a major engine of the Ontario economy and has been for more than a century. But amid the most significant transformation in the history of the automobile—the shift from gasoline powered propulsion to battery electric vehicles—how will the sector thrive and continue to remain a vital part of the provincial economy?

Overview

The assembly of vehicles and the parts that go into those vehicles account for more than 100,000 jobs in the province, contributed $14.4 billion to provincial GDP in 2019 and generate billions of dollars in tax revenue annually for the government. The tentacles of the industry, however, stretch well beyond those raw numbers. Each job in vehicle assembly—there were 37,658 in 2019—creates two more jobs at parts makers, steel companies, plastics manufacturers and transportation and logistics companies, as well as inducing two more in the broader economy.

The vehicle assembly jobs themselves are the second highest paying manufacturing jobs in the province and thus certainly worth preserving and increasing, if possible. Workers at auto making factories took in weekly earnings of $1,591 on average in 2020, 45 per cent higher than the $1,096 average weekly earnings for all employed Canadians. The quality of these jobs as well as the pre-existing auto footprint including a significant domestic supply chain justifies an ongoing policy framework that tilts in favour of investment and employment in the sector especially as it undergoes a transformation.

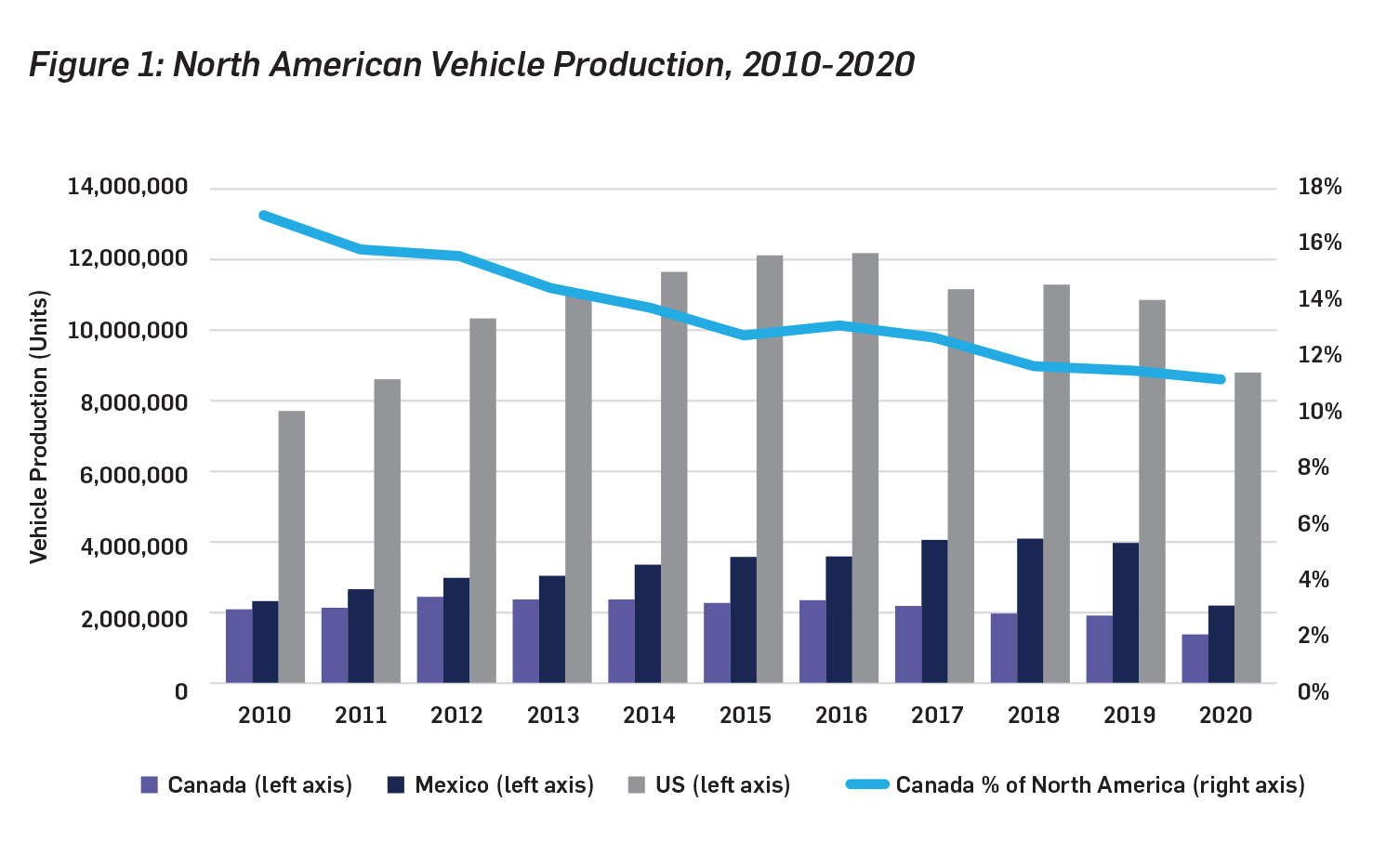

The transformation to an electric vehicle ecosystem represents both an opportunity to sustain and grow the industry’s existing base, but also threatens its very existence. This comes at a time that the industry’s significant presence in Ontario is declining. The key indicators of that are a drop in vehicle output in Ontario and in the province’s share of North American vehicle production.

Production itself fell to 1.92 million vehicles in 2019 (pre-pandemic), its lowest level of the decade and well below the historic peak of more than 3 million reached in 1999. More importantly, Ontario’s share of North American vehicle production dropped to about 11 per cent in 2020 from more than 17 per cent in 2010.

Amid this decline come the opportunities and threats posed by the transition to EVs from the internal combustion engine (ICE) that put the world on wheels. The opportunity is for Ontario to reverse the decline and to participate in the EV ecosystem to an even greater extent than the role the auto sector played during the internal combustion era. The threat is that Ontario will fail to obtain a meaningful share of the billions of dollars in investment that auto makers are pumping into EVs as the end of the ICE era approaches.

Governments around the world are legislating reductions in transportation-related emissions in order to reduce the impact of climate change. In Canada, this includes a mandate that, beginning in 2035, all new vehicles sold in the country are zero emission vehicles.

The U.S. government has not decreed such a mandate, but the Biden administration’s Build Back Better legislation offers a $12,000 (U.S.) rebate to Americans who purchase electric vehicles made in U.S. factories that have unionized work forces, and an additional $500 if 50 per cent of the battery and its components are made in the United States.

The danger this poses to vehicle manufacturing in Ontario is immediate and existential.

If the legislation is approved, the business case to assemble EVs in Ontario will be weak, at best. Ontario-built EVs would effectively be priced out of the U.S. market, which is the destination for more than 80 per cent of the vehicles made in the province.

Even apart from that threat, the shift to EVs will have a major impact on companies that manufacture components for engines and transmissions, which in Ontario includes many of the auto makers themselves. As many as 6,000 jobs and up to $2 billion in annual revenue for companies making these components are at risk in Ontario if they do not find EV work to replace the parts they make for ICE-powered vehicles.

Meanwhile, Ontario, indeed Canada as a whole, has a shortage of skilled tradespeople that will be exacerbated in coming years amid retirements from an aging work force. Canada’s employers face the loss of more than 700,000 skilled trades workers between now and 2028.

These workers will need to be replaced and younger workers and those now in school will need to be convinced that such employment can be a valued and fulfilling career.

All in all, however, things are far from bleak. Ontario’s existing mix of auto manufacturers is a strong advantage. Five companies build vehicles in Ontario and are supplied by world-class parts makers based here. The auto makers are well aware of the skill of the provincial work force, the growing technology sector and the proliferation of research and development centres and activities.

Among these companies, Ford, General Motors and Stellantis have already announced plans to assemble EVs in Ontario. Honda Canada has announced a $1.4 billion investment to assemble hybrid vehicles beginning in 2023 as a step toward manufacturing full EVs.

The recent announcement by Stellantis and LG Energy Solution of the first automotive EV battery plant in Ontario is hugely significant as the province seeks to play a key role in the EV future. The location of the battery plant in Windsor bodes well for Stellantis plants elsewhere in the province.

The Stellantis/LG battery plant—and others that are likely to be located in Ontario—also represents a compelling argument for acceleration of the development in Northern Ontario of cobalt, lithium and other rare earth mines and battery supply chains. The town of Cobalt itself is about a one-day drive from Windsor, while transportation of chromite, copper and platinum from the Ring of Fire north of Thunder Bay would take about two days. Delivery of such minerals from China to Vancouver and then across Canada to Ontario battery plants would take more than a month.

The political stability of Ontario and much stricter environmental regulations in place than those in China, Africa and other sites of rare earth minerals are an added argument for extraction of those minerals in this province.

There is another advantage that may not be evident on the surface. Toyota Motor Corp. said in December, 2021, that its luxury Lexus division will produce EVs only by 2035. Toyota Motor Manufacturing Canada in Cambridge, Ont., assembles the Lexus RX model and increased production of the Lexus NX model in March. It is far from automatic, but that plant would be a leading contender to assemble Lexus EV models.

Recommendations

In light of this transformation occurring in Ontario’s auto sector, here are some key policy recommendations for the province’s incoming government.

1) The first automotive priority for the new government that takes office in June after the provincial election should be to continue to assist, support and join the federal government and the Automotive Parts Makers Association of Canada in trying to eliminate the protectionist threat posed by the Biden administration EV subsidy plan. One key argument that should carry weight is that a dedicated subsidy for U.S.-made vehicles violates CUSMA, the Canada-U.S.-Mexico trade agreement.

As part of the effort to ensure this legislation does not go ahead, Ontario should first take the lead in lobbying key auto producing states with Democratic governors and a significant presence of Canadian parts makers. Michigan ranks first with 50 plants owned by Ontario-based companies that employ more than 15,000 people in the state.

Ohio and Tennessee, which have Republican governors, are next on the list. They might be agreeable to making common cause with Ontario because a high percentage of their vehicle production and assembly jobs are at non-union manufacturers. Alabama, with its three non-union assembly facilities, could be another ally in this effort.

For decades, successive Ontario governments have offered incentives to auto companies making investments in the province—including at existing facilities. The amounts are growing as part of the switch from traditional vehicles, and are effectively the price of admission as auto companies make decisions on where to invest.

Ontario contributed $295 million, for example, to a $1.8 billion Ford project that will involve assembly of EVs at its Oakville, Ont., plant. Incentives such as this will need to be offered to other auto makers to ensure the continuity of automotive manufacturing in the province. The provincial government also will invest $130 million to assist the upgrade of Honda’s Alliston operations.

These incentives are necessary to compete with Mexico and the southern United States for investment and will continue to be vital in the transformation to an EV ecosystem.

2) Although it is home to all of Canada’s light-duty vehicle manufacturing, Ontario lags behind British Columbia and Quebec when it comes to consumer purchases of EVs. Ontario does not offer incentives to purchasers, as those two provinces and others do. Incentives for vehicle purchasers would help convince auto manufacturers of Ontario’s keen interest in supporting its existing assembly footprint and attracting new investment. Such incentives could include a lower sales tax rate on EVs than on traditional ICE vehicles.

3) As they shift out of the ICE past into an EV present and future, auto makers are also reducing the carbon footprint of their manufacturing and other operations. Stellantis, which operates assembly plants in Windsor, Ont., and Brampton, Ont., plans to be carbon neutral by 2038. Toyota’s goal is to produce zero C02 emissions through the entire manufacturing process by 2035. That includes its energy supplies.

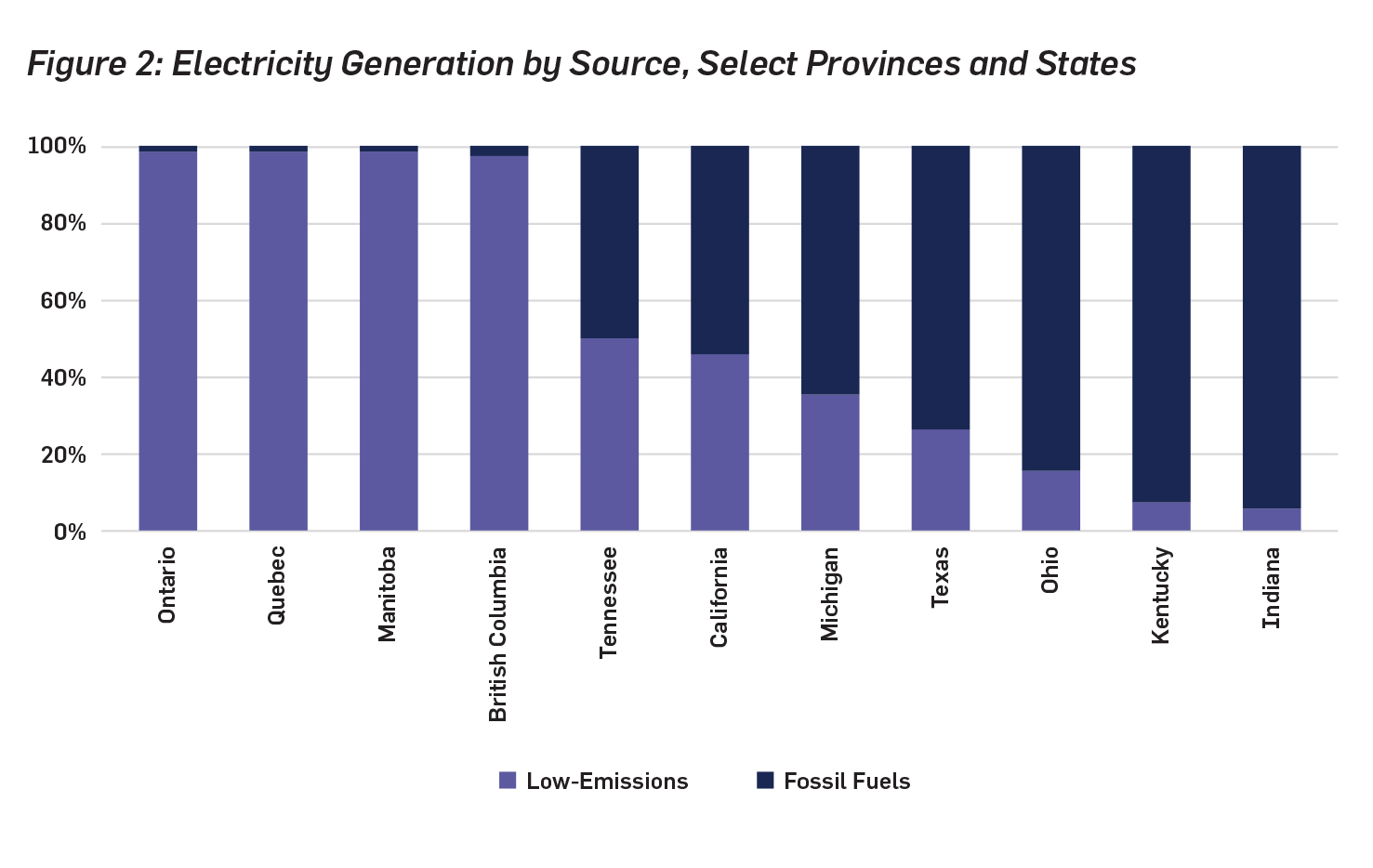

Ontario is perfectly positioned to help Stellantis, Toyota and other companies in the auto sector—and in broader manufacturing—to meet these goals. Ontario’s electric power is generated almost entirely without fossil fuels. The U.S. state with the cleanest power is Tennessee. About 50 per cent of its power is generated by fossil fuels. As Ontario markets itself as the best place in North America to build EVs, it needs to trumpet loudly how much of an advantage this clean power is to companies trying to eliminate their carbon footprints. This would be a critical part of the overall value proposition that Ontario should be presenting to prospective investors in the auto sector.

4) A new provincial government will have a big role to play in addressing the readily apparent need that auto markers and other auto sector companies have for skilled trades workers. As a start, the government should take serious note of an action undertaken by Conestoga College in Kitchener, Ont., and consider making it a pilot project for the entire province or at least for community colleges located in regions where manufacturing is a significant contributor to the local economy.

Conestoga is scheduled to open a skilled trades centre this fall that combines all its skilled trades education in a single, 250,000 square foot facility. The centre will be a few kilometres away from Toyota’s Cambridge, Ont., assembly plants. This centre and others that might follow it could become centres of excellence for skilled trades training. The government also could work closely with auto manufacturers and other companies to identify specific skilled trades needs and enlist support from companies for assistance in instruction.

Another key to addressing this shortage is to convince younger people that skilled trades can be both a stimulating and smart career choice from an economic standpoint. Better co-ordination among companies, the government and educational institutions—including at the high school level—and sophisticated marketing could help address this gap.

5) Auto industry officials interviewed for this report pointed to long approval times for land rezoning and slow provision of services on industrial lands as impediments to investing in Ontario. The creation of a land bank that would purchase and hold land along the Highway 401-402 corridors to the U.S. border and greater ease in rezoning land for industrial uses would help ease that concern.

The government-owned Becancour, Que., industrial park, which has just landed two significant EV battery supply investments, could serve as a model.

6) As noted earlier, many of the critical minerals needed for EV batteries are in the ground in Northern Ontario and thus represent a competitive advantage for auto makers in the province.

The new provincial government should provide a transparent and detailed road map of how it will enable the mining sector to start supplying these minerals to downstream users. The road map should outline how development will have as little impact on the environment as possible. The road map should also reflect the values, concerns and participation of Indigenous peoples.

Greg Keenan is editor and strategic advisor at the Trillium Network for Advanced Manufacturing.

Brendan Sweeney is managing director of the Trillium Network for Advanced Manufacturing.