Policy Papers

ON360 Transition Briefings 2022 – All Charged Up: How Ontario Can Boost Electric Vehicle Production And Usage

Ontario lags behind the national average in uptake of electric vehicles, which has both economic and environmental impact. In this paper, Munk student Connor Fraser analyses the situation, and makes recommendations to boost production and deployment of EV’s.

Issue

Provincial uptake of electric vehicles (EV) lags behind the national average, putting Ontario’s 2030 climate targets at risk. A 2019 audit, for instance, found that while the government’s emissions reduction targets require a substantial increase in EV use in the province, the level of take-up is still well below where it ultimately needs to be.[1]

Expanded EV manufacturing and usage is further complicated by the introduction of protectionist subsidies for US-built EVs proposed within the Biden Administration’s Build Back Better agenda. Automakers will therefore be faced with difficult decisions about where to locate innovative manufacturing operations.

By implementing a broader suite of policy measures to support EV adoption, Ontario can both reinforce its manufacturing base and make greater progress on its climate targets.

Overview: Electric vehicle policy in Ontario and Canada

Transportation is Ontario’s largest GHG-emitting sector. The government’s 2018 Made-in-Ontario environment plan allocates 16% of provincial emission reduction targets towards the uptake of EVs[2] – equivalent to approximately 625,000 vehicles by 2030.[3] Beyond eliminating GHG emissions, EVs have additional benefits for consumers such as lower fuel and maintenance expense.[4]

The provincial plan interacts with federal policies that also tilt in favour of EV production and adoption. The federal government offers a $5,000 rebate on select EV models. Furthermore, a proposed nationwide mandate would require 100% of new vehicle sales to be electric by 2035.[5]

Back at the provincial level, Ontario has announced partnerships with automakers such as Ford, Honda, and General Motors that would see more than 400,000 EVs manufactured locally by 2030.[6] Ontario’s automotive sector employs roughly 100,000 people.[7] Concurrently, a joint venture between Hydro One and OPG aims to connect Ontario with a network of 160 fast chargers by 2022.[8]

While these policies are beneficial, they do not sufficiently address factors such as the need for expanded private and public charging infrastructure or account for unexpected risks introduced by American protectionist policies.

This briefing note outlines how an incoming Ontario government post-election might use a wider range of policy tools to incentivise greater adoption of EVs.

The Need for Reform

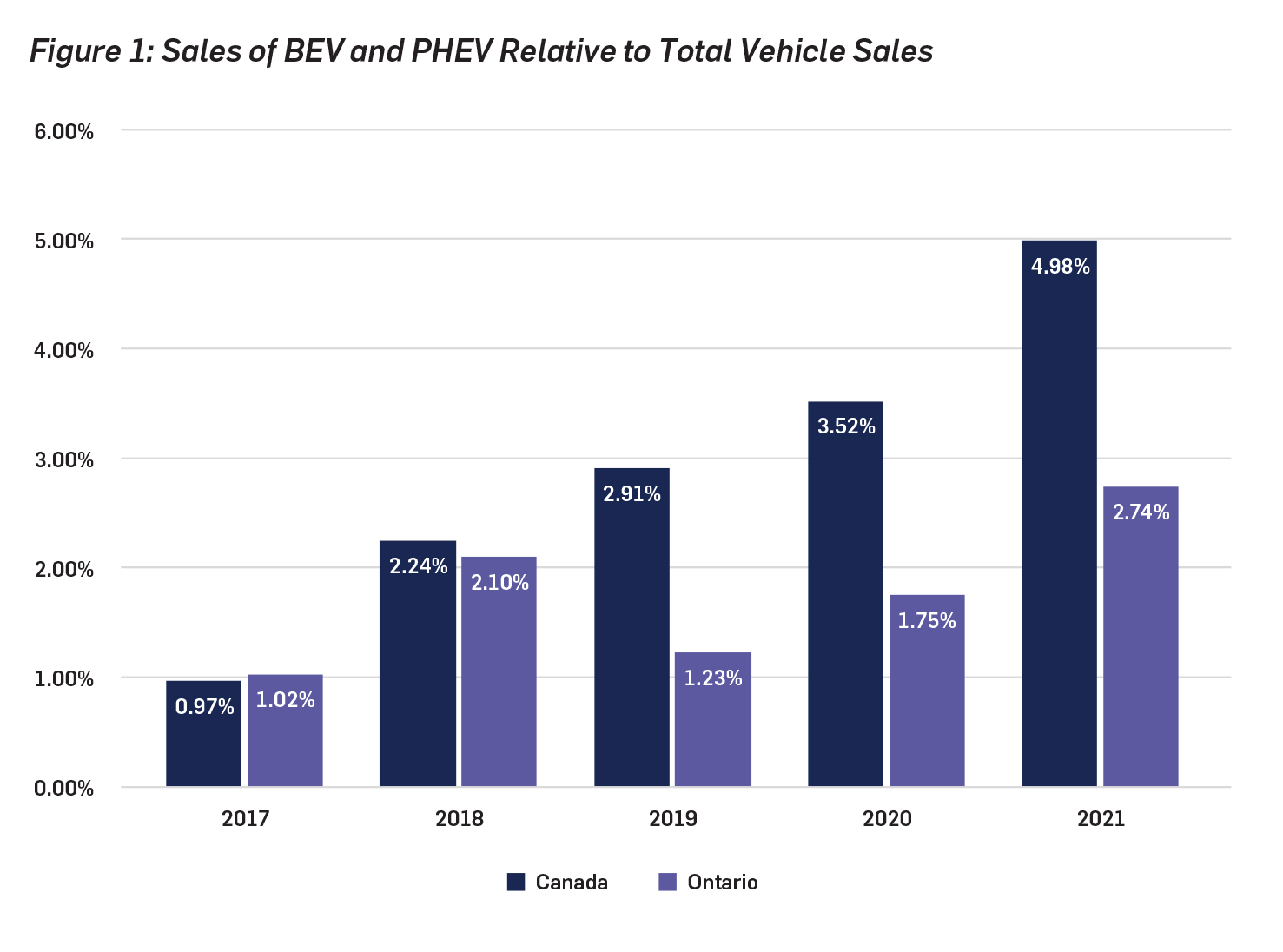

Figure 1 depicts sales of zero emission vehicles (ZEV – defined as battery electric and plug-in hybrid electric vehicles) in Ontario and Canada as a percentage of total vehicle sales.[9] Ontario’s total vehicle fleet is expected to reach 10.2 million by 2030[10], of which 625,000 EVs represents 6.1%. In order to even meet that level, annual EV sales between now and 2030 need to average considerably higher than 6% of new vehicles to catch up for the current lag in relative EV sales.

Build Back Better is a major headwind for Ontario’s manufacturing sector

- The Biden Administration has proposed a US$12,500 tax incentive for Americans to purchase domestically manufactured EV models. Such an incentive would decrease the competitiveness of EVs built within Canada and displace manufacturing projects planned within Ontario. While Ottawa has threatened retaliatory tariffs, experts warn that some version of the US incentive will likely pass Congress.[11]

- Under this scenario, automakers who build EVs in Ontario would be at risk of serious losses if product demand within Canada did not exceed the breakeven manufacturing quantity. This underscores the need for Canadian governments, including Ontario’s, to be prepared with a comprehensive suite of policies that promote rapid adoption of EVs, including possibly demand-side incentives, to stabilize the economics for automakers regardless of where production is located.

- Canadian-built EVs will only represent a fraction of the options available to consumers. Thus, faced with the US incentive, Canadian EV demand would need to outpace local supply by a wide margin to both maintain consumer choice and reassure manufacturers.

Providing narrow policy support increases the future costs of Ontario’s EV transition

- There are two broad ways in which government policy can support the growing role for EVs in transportation. The first is by incentivizing supply. Ontario’s ambition to attract EV manufacturers using a mix of direct and indirect subsidies can be framed as an attempt to increase the supply of vehicles in the marketplace. The other is by encouraging demand. The federal government’s pursuit of an EV sales mandate is also a demand incentive which would effectively create an enlarged consumer market.

- EVs are distinct from internal combustion engine (ICE) vehicles in the ways they interact with people and infrastructure. The rapid transferability of gasoline has resulted in refueling at centralized locations. Conversely, electricity is transferred into batteries at a slower rate and consumers overwhelmingly prefer the convenience of charging at home whenever possible.[12] This has infrastructure implications and, in turn, public policy considerations.

- Ontario’s current policy focuses exclusively on the supply of vehicles. It has not really addressed the supply of associated charging infrastructure. Yet, the lack of charging infrastructure has been cited as major barrier to EV adoption in Ontario,[13] Canada,[14] and other jurisdictions.[15] Evidence suggests that the private sector is not consistently providing EV charging infrastructure in new residential and commercial developments, if at all.[16] Additionally, equipping existing multi-unit buildings with EV chargers creates governance hurdles when non-EV users do not want to share the costs of electrical panel upgrades.[17]

- The uptake of EVs is expected to increase dramatically towards 2035 as the federal sales mandate approaches 100%.[18] Without simultaneous support for infrastructure, there is a risk of a future demand-supply imbalance in the market

for charging equipment. This could increase costs for consumers, and raise frustration with EV technology. - Such an imbalance could also influence prioritisation of public charging infrastructure above private infrastructure, thereby forgoing the convenience of and widely known consumer preference for home charging. The economic viability of public charging infrastructure is unclear. Many studies report significant underutilization, suggesting that public charging infrastructure should be carefully planned.[19]

- Through zoning bylaws, municipalities have authority to implement EV charging requirements for outdoor parking lots that do not fall under provincial building codes.[20] Therefore, close cooperation with municipalities will be essential to developing effective public infrastructure.

- There may be a role for public policy (including direct and indirect support), therefore, to boost the installation of public and private charging stations.

How to move forward

- Prepare a strong response to potential Build Back Better incentives. Ontario might consider pre-emptively announcing an intention to implement demand-side incentives for Canadian-built EVs in the event that a protectionist EV measure passes Congress. For example, researchers from the University of Toronto found that a $3000 scrap incentive on 10 years or older ICE vehicles could significantly impact near-term EV demand.[21]

- Ontario might also consider negotiating with other provinces and the federal government to simultaneously alter their existing EV purchase incentives such that they apply exclusively towards Canadian-built EVs.

- A coordinated Canadian response could re-assure automakers that Ontario manufacturing output will be met with sufficient local demand, and demonstrate to US lawmakers that little advantage would be gained from protectionism. If Ontario aspires to manufacture 400,000 EV by 2030, there is no reason why most of those vehicles could not be driven by Canadians.

- In the absence of the American Build Back Better incentive, it is not clear whether demand-side incentives would be necessary for Ontario, especially if the federal government proceeds with the nationwide 100% EV-sales mandate by 2035. Such a mandate offers strong consumer benefits, such as greater model availability and experiential learning opportunities at dealerships. Ontario could benefit by supporting its implementation, or by introducing its own sales mandate in the event a future federal government scraps the target.

- Proactively facilitate construction of private charging infrastructure. By not devolving building code authority to municipalities regarding charging infrastructure associated with private, indoor spaces, the government can promote consistent, province-wide adoption of standards where possible. Moreover, by signalling an intention to catalyze greater private infrastructure, the provincial government could concurrently signal a desire to see municipalities play a greater role in filling the remaining gaps of public infrastructure. This may be an optimal division since zoning bylaws offer more flexibility as they relate to land use.[22] Approaching charging infrastructure in this fashion has the benefits of maximizing the convenience of private charging, accommodating travelers and those without private options, and minimizing the potential underutilization of widespread public charging infrastructure.

- Introduce building code requirements that all new dwellings (both single detached, apartment and condominiums) be equipped with Level-2 charging capacity and energy management systems for 100% of indoor parking spaces.[23] EV ready infrastructure will maximize the compatibility of this technology with consumer’s lifestyles, and eliminate the need for expensive future renovations.

- Require that owners of existing apartment buildings and condominiums equip 100% of indoor parking spaces with Level-2 charging capacity and energy management systems by 2035. Implementing this requirement might be

aided with a standalone legislative tool. - For condominiums, the government could offer to cover one quarter of renovation costs before 2025, one fifth before 2030 and none thereafter, with fines for non-compliance beginning in 2035. To demonstrate a commitment to equity, for apartments, co-ops, and community housing, the government could offer to cover half of renovation costs before 2025, one third before 2030 and one fifth before 2035. Noncompliant landlords of these complexes (including municipalities, in the case of community housing) could be targeted with even more stringent fines after 2035.

- Without strong direction, governance issues might delay apartment and condominium residents from benefitting from convenient charging infrastructure and prolong use of ICE vehicles.

- Work with municipalities to plan targeted public charging infrastructure.

- Since municipalities have control over open-air parking spaces through zoning bylaws, close cooperation on a strategy for public charging infrastructure will be essential to accommodate Ontarians without private options. This might include adding an explicit building code provision that green-lights municipal zoning bylaws as they pertain to workplace and commercial charging. Such a provision could be followed by provincial encouragement of municipal leadership by mandating all workplaces (existing and planned) have a small percentage of parking spaces equipped with Level-2 chargers for exclusive use by those without access to private, indoor parking. This arrangement is designed to encourage owners of existing, single-detached dwellings with indoor parking to install charging infrastructure within their own homes.

- Additionally, the province might extend encouragement to bylaws that ensure all shopping, grocery, and community centres have a small percentage of parking spaces equipped with Level-3 chargers.[24] The percentage should be increased for those locations within a short radius (i.e. 2km) of highway exits to ease range anxiety of those making long distance trips. Promoting highway-proximate infrastructure in this manner would offer the added benefit of maximizing utilization in periods of low travel, while offering minimal inconvenience to travelers.

Connor Fraser is a Master’s Candidate at the Munk School of Global Affairs & Public Policy and the Rotman School of Management.