Policy Papers

Made in Ontario: A Provincial Manufacturing Strategy

This paper explores why manufacturing matters greatly for Ontario and outlines steps on how the province should engage supportive policies and partnerships to ensure Ontario remains Canada's manufacturing hub.

Executive Summary

This paper addresses a straightforward question: “Should the Ontario government specifically try to create growth in the manufacturing sector, or should it simply focus on creating the best possible environment for business, and be indifferent to which sectors grow?” Our answer: Manufacturing matters greatly for Ontario, and the province should engage more through supportive policies and partnerships to ensure that Ontario remains Canada’s manufacturing hub.

Our reasoning is as follows:

Manufacturing is a source of growth and employment, particularly in mid-sized cities and smaller communities: Other fast-growing sectors, such as finance and professional services, tend to cluster in large cities, whereas manufacturing often performs well in mid-sized and smaller communities. Simply trying to grow the economy as a whole may concentrate employment growth in and around Toronto and Ottawa, causing slow-to-no growth in communities that are not proximate to these cities. Policymakers should view a manufacturing agenda as part of a larger economic strategy to help the growth of mid-sized and smaller communities across Ontario. This will ensure that the benefits of economic growth are more evenly distributed, and that well-paying, middle class jobs are available across the province.

Manufacturing creates benefits, like jobs and investment, for the entire community: Manufacturing has a great potential to stimulate employment across the entire economy, as well as innovation spillovers into other sectors. As a common saying goes, “a new manufacturing plant in a town will attract a Wal-Mart, but a new Wal-Mart will not attract a manufacturing plant.”

Manufacturing makes us better prepared to face a crisis: Having a robust manufacturing sector allows for the production of needed supplies during an emergency, improving regional resilience, as evidenced by the coronavirus pandemic.

Manufacturing can create jobs making cleaner, less polluting technologies: The world is about to embark on a cleantech revolution, as countries race to hit net-zero emissions. This is a massive economic opportunity to redesign Ontario’s manufacturing and competitive advantage. Ontario can contribute by not just reducing emissions, but by paving the road to a “race to the top” which will encourage our trading partners to also reduce emissions. A viable pathway for clean economic growth is by designing and manufacturing the technologies necessary in a net-zero world.

There are several policy approaches the Ontario government could take to revitalize the manufacturing sector. To capture existing comparative advantages, the Ontario government will need to thoughtfully and meaningfully partner with industry and other economic actors in supporting the revitalization of Ontario manufacturing. Efforts to revitalize the manufacturing sector and to build up productive capacity must account for the needs and challenges faced by particular regional economies. Policymakers should design and implement targeted policies to better support high value-added manufacturing in a changing global economy.

The best available path is to develop and implement policies that are tailored to the manufacturing sector. These policies must also be geographically sensitive, as the manufacturing sector performs differently in different communities. Despite the necessity for customizable policies and solutions, some general recommendations should be considered in all scenarios:

- Policymakers should run ongoing and meaningful consultations with manufacturers and stakeholders across each region of the province to better develop policies especially designed to address the needs and challenges of specific communities.

- The revitalization of manufacturing will depend on a highly skilled workforce. It is important to invest in the upskilling of manufacturing workers, especially in those soft skills that tend to be overlooked in educational curricula, but that remain important to support Ontario’s advanced manufacturing.

- It is absolutely necessary to diversify the manufacturing workforce by implementing policies and programs that remove structural barriers to the full economic participation and advancement of untapped potential.

More specifically, this paper recommends the following policy prescriptions:

- To aid the growth of manufacturing start-ups, the provincial government should create an investor tax credit to generate more support for start-ups and to help the sector attract more risk capital.

- To attract foreign direct investment and aid the scale-up of domestic companies, the provincial government should institute deep, targeted, time-limited, corporate tax cuts, for manufacturing subsectors deemed to be of strategic importance.

- To strengthen Ontario’s manufacturing ecosystem as a whole, the provincial government should translate successful policies from both the Manufacturing USA Institute model and NextGeneration Innovation Supercluster into provincial policy.

Context

As Ontario recovers from the economic shock caused by the pandemic, there is a need for the provincial government to focus on job creation and economic growth. Virtually everyone agrees that recovering lost output and jobs will be crucial to restoring the province’s public finances and helping communities and households get back to pre-pandemic outcomes.

The big question, of course, is how should the government pursue these goals of jobs and growth?

One option is to focus on creating an “open for business” environment in general terms, and to let market forces determine where and how growth will occur. If the market decides that the manufacturing industry should whither, so be it.

We argue that this would be a mistake. Any set of public policies, no matter how broad-based, will benefit some industries more than others, and there is a real risk that a one-size-fits-all approach will concentrate the economic gains with white-collar workers in Toronto and Ottawa, leaving the rest of the province behind. While this could be corrected through redistributive policies, we argue that a more sensible approach is a suite of policies to ensure opportunities and growth for all Ontarians. The better means is to develop a policy framework that shapes market outcomes to bolster activities in sectors and communities that help to achieve inclusive growth.

Tailored support to manufacturing is, in our view, a viable option to expand economic opportunities for all Ontarians, regardless of where they live in the province. The manufacturing sector has traditionally been a source of well-paying jobs and a channel for upward mobility in the province. However, the sector has too often been written-off as a source of growth, as it has experienced significant turbulence.

The intensification of globalization led to manufacturing in Ontario undergoing significant restructuring, favouring the production of durable goods and the offshoring of manufacturing of non-durables to low labour cost countries. Amid these significant changes and the rise of global supply chains that fragmented the production of goods across the globe, the total share of manufacturing employment significantly declined since the 1970s. This was not unique to Ontario, but was a common pattern seen in many jurisdictions, including in the European Union and in the United States. As a reaction, policymakers and scholars began questioning the importance of manufacturing in high- income economies in the current global economic context.[1]

Given this ongoing decline in manufacturing employment’s share, it would be easy to dismiss the growth prospects of the sector, and instead turn our attention elsewhere. If that were to mean the sector would disappear, that would be an acceptable outcome so long as the economy as a whole grows, or so goes one commonly-held perspective. But this view is faulty and would be a mistake. We argue that manufacturing remains a key sector to drive long-term and sustainable economic growth for Ontario. Manufacturing continues to be a source of good-paying jobs with the potential to generate many others in other sectors, stimulating entire regional economies.[2] Having a manufacturing base in the province is valuable, as it creates innovation spillovers into other sectors and improves overall productivity.[3] As manufacturing firms tend to cluster in mid-size cities, the revitalization of this sector is likely to reinvigorate regional economies that miss out on the benefits associated with growth in finance and professional services, which are usually concentrated in large, well connected cities.[4] Globalization also offers new opportunities for capturing portions of manufacturing value-chains that are based on regional expertise, making it a driver for regional economic development in a world of international supply chains.[5]

The focus of this paper is not to make the case for pro-growth policies per se, but rather to focus on the form those should take and if there should be particular attention paid to the manufacturing sector. We ask:

Should the Ontario government specifically try to create growth in the manufacturing sector, or should it simply focus on creating the best possible environment for business, and be indifferent to which sectors grow?

Ontario has a long tradition in manufacturing. With a highly educated workforce resulting from a robust educational system, and well- developed infrastructure, the province rests on strong comparative advantages.[6] These advantages will be particularly helpful in positioning the province to compete in the fast-growing cleantech sector that international markets are focusing on to reduce pollution and fight climate change.

However, for Ontario’s manufacturing sector to achieve its promise, the right policy mix must be set in place. Focusing on creating a business environment without specific support for manufacturing can advance economic growth in overall terms, but it will not necessarily create jobs and opportunities in communities that have continuously been left behind in recent decades. This could exacerbate regional differences and economic conflicts.

What happened to manufacturing in Ontario?

The short answer is globalization and automation.

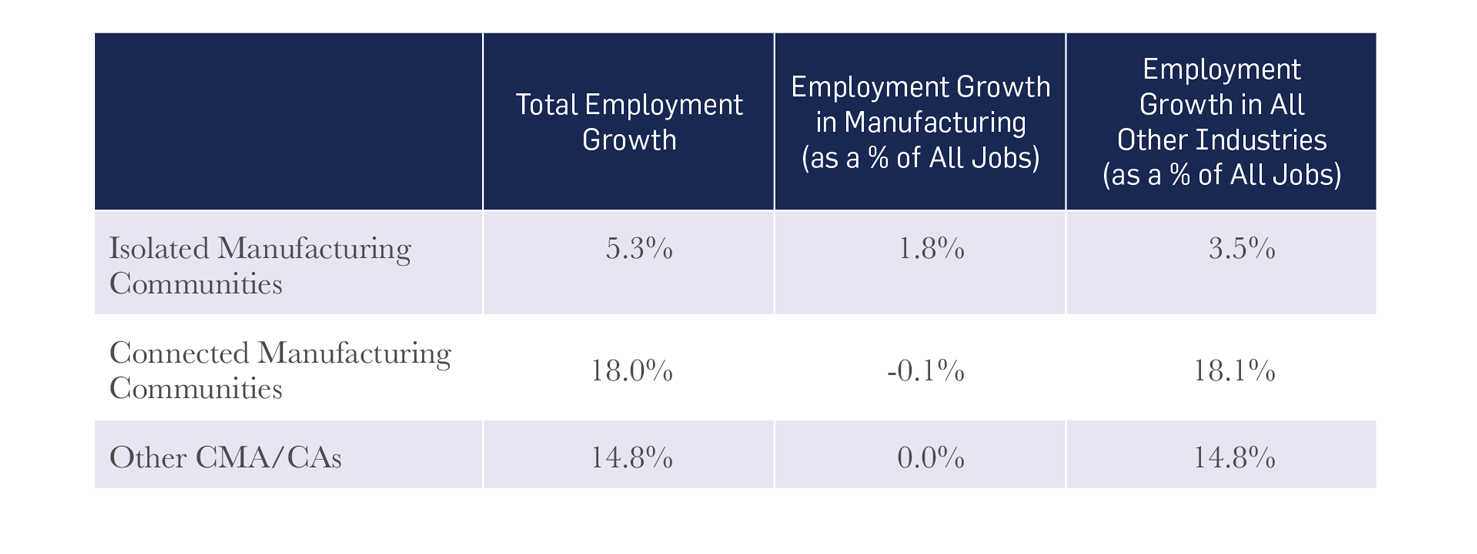

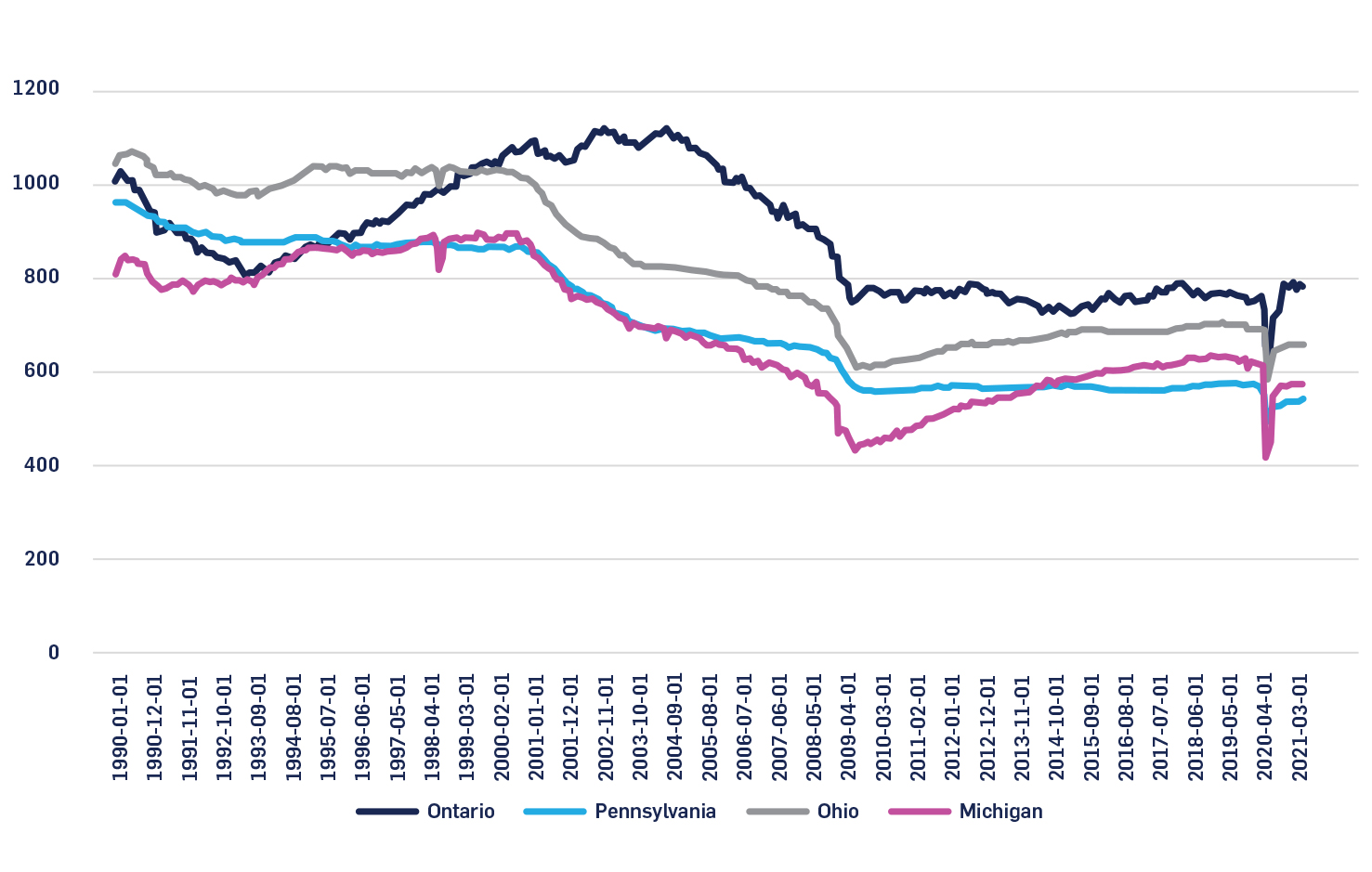

Declines in manufacturing employment, at least as a share of total employment, have been largely consistent across Organisation for Economic Co-operation and Development (OECD) member countries since the 1970s.[7] Canada was one of the few exceptions that experienced an increase in manufacturing jobs from 1990 to 2003, but historical trends still show a reduced share compared to 1970.[8] Ontario, along with our Great Lake neighbours, has experienced a substantial decline in the number of manufacturing jobs over the past 30 years (Figure 1). Although the number of jobs has been flat since 2009, output has steadily, albeit modestly, increased since then, pointing to a sector growing through productivity gains rather than increased employment (Figure 2). The relative lack of net job creation has meant the industry as a whole became seen as less important for economic growth, as the province moved towards a more service and knowledge-based economy.

Figure 1: Manufacturing employment by jurisdiction, 000s, seasonally adjusted.[9]

Figure 2: GDP from manufacturing in Ontario, millions of chained (2012) dollars.[10]

However, despite the shift in narrative, manufacturing continues to be a mainstay sector for Ontario, adapting to several economic shocks over the past thirty years: The recession of the 1990s, free trade agreements with the United States, the “China Shock’’ caused by increased competition from Chinese manufacturers, currency and exchange rate volatility brought on by oil market fluctuations, and the financial crisis of 2008-2009 have not proven individually or cumulatively strong enough to completely upend Ontario’s manufacturing sector. If anything, the sector includes incredibly resilient companies. Firms that can survive a China Shock, Dutch Disease, and a global financial crisis are well-positioned to survive future upheaval.

Although manufacturing employment numbers stagnated in the recent past, the sector remains a significant source of jobs in absolute terms. Over the past five years, manufacturing employment in Ontario has represented roughly 11% of total provincial employment, and almost half of the manufacturing jobs in the country.[11] These jobs are generally well-paying, reporting a total compensation of $84,347 in 2019.[12] Beyond employing a large number of Ontario workers, evidence suggests that high shares for manufacturing employment are positively correlated with economic growth, meaning that manufacturing employment continues to be important, especially for local economies.[13]

Why does manufacturing matter in Ontario?

Without manufacturing, mid-sized and smaller communities in Ontario risk being left behind economically.

Manufacturing is a source of economic growth in mid-sized cities and smaller communities. Economic growth has been uneven across Ontario communities during the 21st century, as highlighted by Eisen and Emes[14], with areas around Ottawa and Toronto growing quite quickly, and Northern and Southwestern Ontario experiencing slow growth. This has led to the creation of a “two-speed economy”, where jobs were typically created in major urban areas. As the market increasingly concentrates economic opportunities, manufacturing can offer a solution for job creation in mid-sized cities and smaller communities across the province.

Much of Ontario’s two-speed economy[15] mirrors what was described by Moretti[16] in “New Geography of Jobs”: The fastest growing industries of the 21st century, from internet and communications technology to finance, tend to require large pools of specialized labour. This need for “thick labour markets” – those with high concentrations of workers with particular skill sets that are in high demand – causes companies in these sectors to locate in large cities.[17] Across North America and Western Europe, this clustering of economic activity in large cities is causing communities to be left-behind, increasing the need for place-based policies.[18]

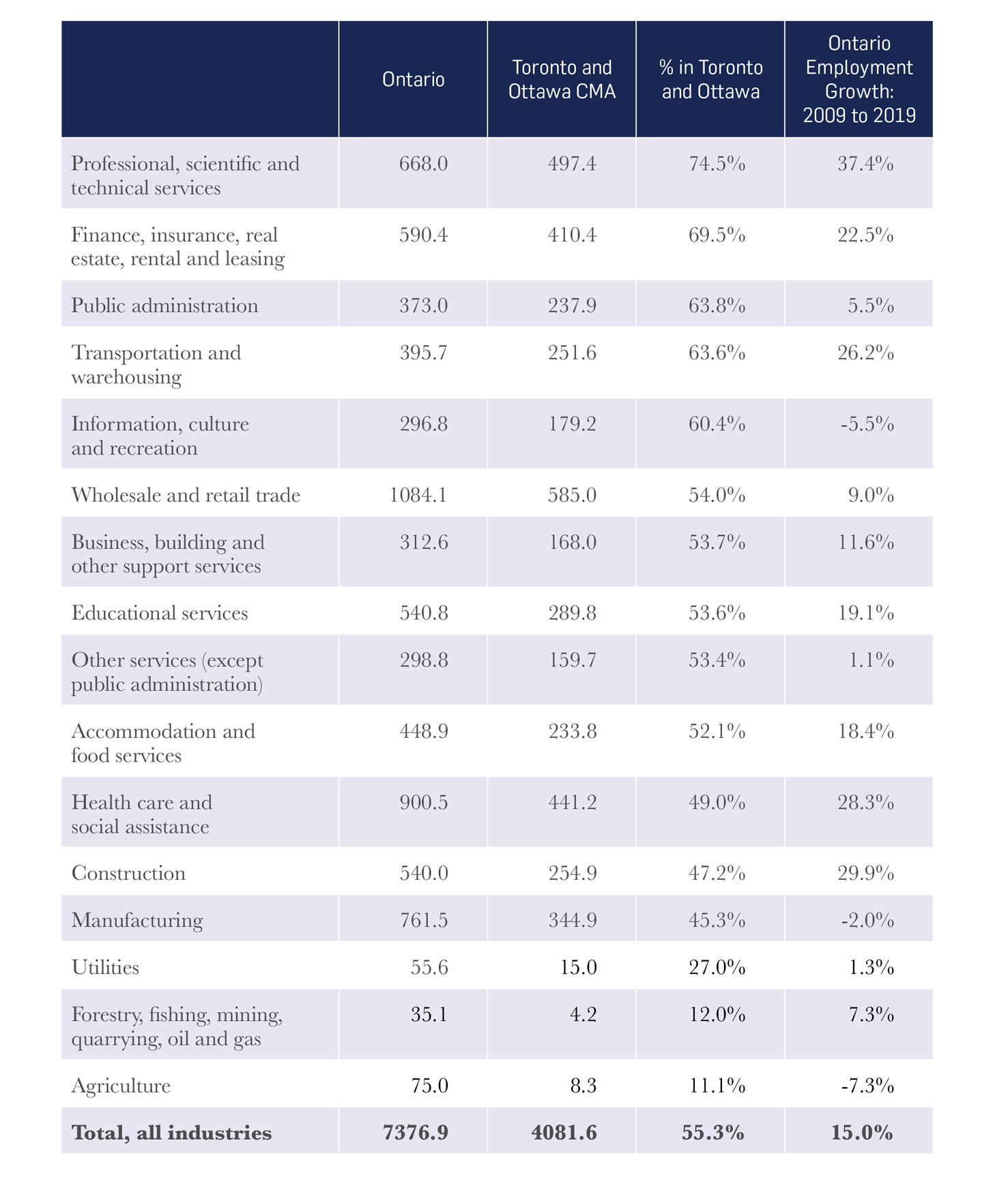

We can see this phenomenon at play in Ontario. Roughly 55% of all employed Ontarians live in Toronto or Ottawa CMAs[19], but those two cities contain almost 75% of the province’s fast-growing “professional, scientific, and technical services” workers, and almost 70% of those employed in “finance, insurance, real estate, rental and leasing” (Table 1). However, only 45% of the province’s manufacturing workers live in those two cities, as manufacturing traditionally has not required such large pools of specialized labour.

Table 1: Employment by Sector in Ontario in 2019, in 000s, Toronto and Ottawa CMA vs. rest of the province.[20]

A decline in manufacturing employment between 2003 and 2009 is a direct component of Ontario’s two-speed economy, whereby the Toronto and Ottawa regions grew quickly, whereas other parts of the province did not. In a recent study, Moffatt[21] examines the employment trajectories of 65 Canadian communities[22] from 1997 to 2018. His findings suggest that 25 of those communities lost a substantial number of manufacturing jobs during the 2003- 09 China Shock and the financial crisis. The further a community is away from one of Canada’s three biggest cities (Toronto, Montreal, and Vancouver), the more economically isolated they become. Proximity to large urban centres is highly associated with economic connectivity.

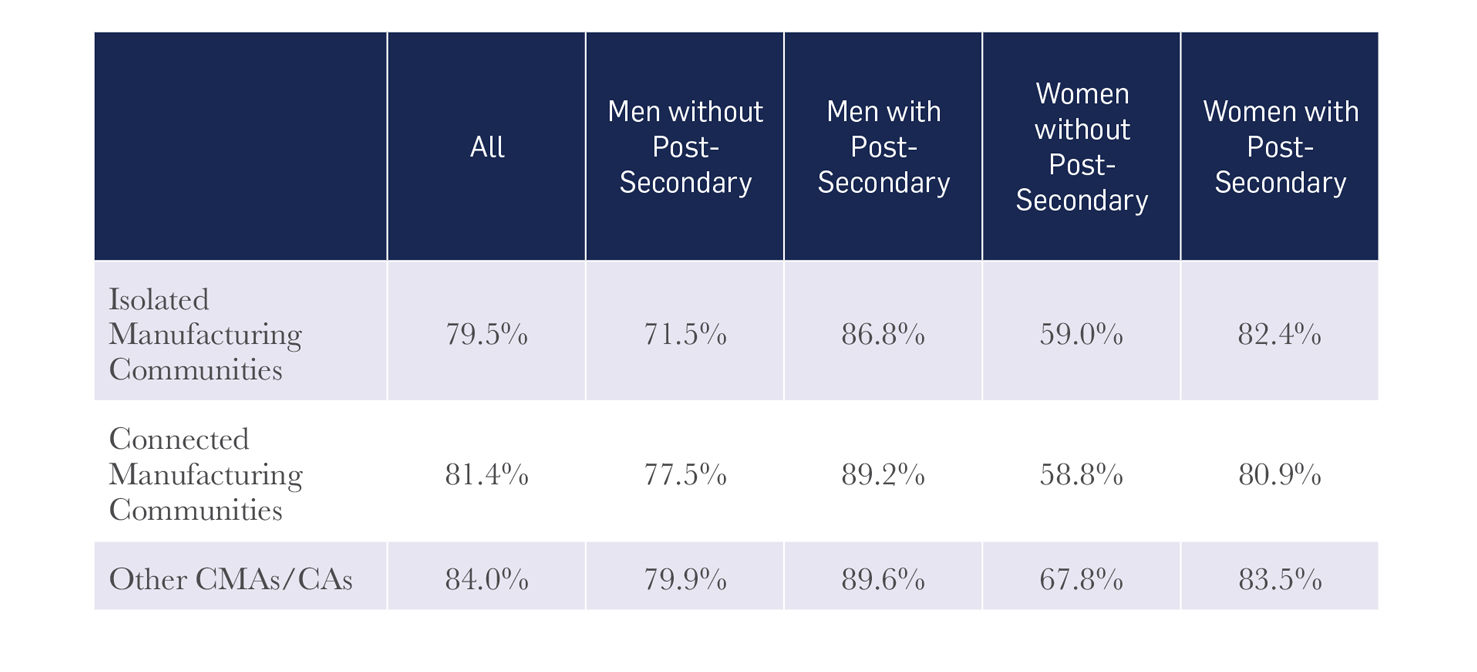

Since the end of the financial crisis, and through 2018, isolated manufacturing communities across Canada experienced little employment growth, while connected and non-manufacturing regions experienced robust growth. However, all net employment growth in manufacturing since the end of the financial crisis has occurred in isolated manufacturing communities (Table 2).

Table 2: Employment growth by Canadian community type, 2009-18.[23]

As big cities experienced job growth in sectors from information and communications technology to finance, they created a whole host of spin-off jobs in transportation, warehousing and construction. This helped absorb the types of workers who had traditionally worked in manufacturing, but this occurred almost exclusively in Ontario communities that were near the Toronto CMA (as well as the Toronto CMA itself). Between 2003 and 2018, in Toronto, Oshawa, Guelph and Kitchener-Cambridge-Waterloo, for every (net) job that was lost in manufacturing, a job was created in transportation, warehousing and construction. This did not hold true in more isolated communities such as London, Windsor, and Chatham-Kent, where job creation in these sectors was minimal, as described in Table 3.

Table 3: Job Gains/Losses in Manufacturing Sector Versus Transportation, Warehousing, and Construction Sector by Ontario CMA/CA, 2003-2018.[24]

Because of this lack of job creation in transportation, warehousing and trucking industries in isolated manufacturing communities, such places have experienced lower employment rates than their connected and non- manufacturing counterparts. This holds particularly true for men without post- secondary credentials, who have found reduced employment opportunities in isolated manufacturing communities (Table 4). Over the past two decades, the transportation, warehousing and construction industries have absorbed many of the workers who would traditionally have been employed in manufacturing, but only in communities that created jobs in those sectors.

Table 4: Employment Rates by CMA/CA Type, Sex, and Education Level for Canadian Workers Aged 25-54, 2018.[25]

An economic growth strategy that is indifferent to sectoral growth risks inadvertently focusing on sectors that require the thick labour markets that only the Toronto and Ottawa regions provide in Ontario. Place-based private-sector growth strategies are needed, from agriculture, forestry and natural resources in rural and remote communities, to a manufacturing strategy to accelerate growth in mid-sized cities outside of Toronto’s economic orbit. Failure to do so will create the economic, social, and political tensions associated with places that are “left behind”.

Manufacturing creates benefits for the entire community

The revitalization of manufacturing is a promising avenue to reinvigorate the economies of isolated communities, bridging the economic divide between midsize and large cities. Like other sectors, manufacturing is not a stand-alone set of economic activities. Rather, manufacturing industries are deeply connected to other industries, forging forward and backward linkages, two concepts used since the 1970s to imply industrial interdependence.[26] Manufacturers do not simply create job opportunities within a specific industry. They stimulate the creation of a large number of indirect jobs in other industries as well. For instance, a vibrant manufacturing industry will energize demand for inputs of production, which encourages employment and stimulates economic activity in other sectors because manufacturing workers’ incomes are likely to be spent on local retail, restaurants and leisure activities. This, in turn, ends up stimulating the entire economy. This employment multiplier effect is usually larger in manufacturing than in other sectors.[27]

As manufacturing firms forge linkages with other manufacturers and suppliers responsible for different stages of a highly fragmented production process, manufacturing firms induce productivity and investments within the entire industry.[28] The potential for technological and knowledge spillovers is also significant. Manufacturing is not only highly sensitive to innovation, but technology, procedures, and knowledge originating in the production of goods can spill over into other sectors, raising overall economic productivity.[29] Indeed, manufacturing has a unique capacity to incentivize technological innovations, and to generate spillover benefits passed on to several other sectors.[30]

Manufacturing makes us safer and better prepared for a crisis

The pandemic-induced economic slowdown has shown the value of having critical manufacturing infrastructure in the time of crisis. Ontario’s manufacturing, for instance, has been unable to meet the demand for medical equipment and vaccines, and not just because of the public health emergency. The revitalization of Ontario’s manufacturing would improve the province’s preparedness to confront two potential risks in our globalized economy: supply chain disruptions, and health and safety risks.

A building up of Ontario’s manufacturing capacity in key strategic areas would enhance the province’s resiliency in the context of a globalized economy facing increasing conflicts and environmental disasters. Global supply chains are vulnerable to damage in their links, which can then impact the entire supply chain.[31] The Fukushima nuclear disaster in 2011 is an illustrative case. This nuclear accident led Japanese suppliers to scale down production, which then brought entire value chains to a halt.[32] More recently, the Suez Canal blockage, caused by a stuck container vessel, placed global supply chains under significant pressure. A recent report suggests that industries in North America particularly impacted by this incident included surgical and medical equipment, semiconductor, plumbing, heating and air-conditioning.[33] Overly complex manufacturing supply chains, which are highly dependent on imported parts, can be disrupted during a time of crisis.

The revitalization of manufacturing in Ontario can also mitigate health and safety risks. A main motivation for reshoring production plants, according to manufacturing firms, has been the low quality of production at outsourced contractors.[34] Quality control is a major and costly issue in global supply chains. The domestic development of manufacturing capacity in strategic industries such as medical supplies, pharmaceuticals, and chemicals would reduce health and safety risks associated with low quality products produced in regions with lax regulations and weak intellectual property rights.

Cleantech is needed and Ontario has a vital role

The world’s three largest economies (the United States, the European Union and China) have all pledged to reduce greenhouse gas emissions to net-zero by 2060, at the latest.[35] This shift towards lower-emitting technologies is transforming all sectors, and represents a massive opportunity for Ontario manufacturing. Ontario can use these technologies to not only lower the province’s own emissions, but to help lower those of its trading partners.

The economic case for clean technology manufacturing is not that much different than for other forms of high- tech manufacturing. Clean technology manufacturing offers a host of benefits to regions and communities. Clean technology companies, including manufacturers, are subject to a number of market failures including higher than average rates of economic spillovers.[36] These spillovers make it harder for companies to capture the full economic gains that emerge from their investments. Moreover, this applies to all innovation – not just invention of new technologies. As manufacturing is a divided, segmented sector, with individual invention, design, parts production and assembly tasks being fragmented amongst hundreds of companies, the capturing of these spillovers can occur at any stage of the innovation and production process.[37]

Specialized firms can grow and create supporting industries around them. This is more likely in clean technology operations primed for growth. These supporting industries, which can emerge as a result of regional know-how and expertise, develop clusters and can create additional jobs in clean technology sectors, thereby having positive additional economic effects. Unlike traditional labour-intensive manufacturing, the competitiveness of cleantech is also shaped by research and development (R&D) and technological innovation. This means clean technology industries tend to create highly-skilled, technical, well-paying jobs, making them even more attractive.

The benefits of having cleantech manufacturing in Ontario are also not purely economic. There are substantial international benefits, as these technologies are vital if the world is to hit net-zero emissions. Due to their global importance, we must ensure that cleantech development and production is not dominated by the geopolitical adversaries of Canada and its closest allies. Chinese clean technology sectors already manufacture almost 50% of global electric personal vehicles, and 90% of electric heavy-duty vehicles.[38] If Canada does not manufacture more clean technology for domestic use or export, it risks falling behind geopolitical competitors in the race to capture market share in a decarbonizing world. This matters for both Canada and its allies: In U.S. President Joe Biden’s first address to Congress, he noted that his country is “in a competition with China and other countries to win the 21st Century”.[39] By manufacturing these technologies, Ontario can ensure an adequate supply of them for Canada and our allies, and do its part in the global fight against climate change.

Ontario can also ensure that Canada’s continued contribution to the fight against climate change is supported by the building and exporting of technologies that reduce greenhouse gases and pollution. Canada’s role as a global leader in the fight against climate change can more robustly integrate clean technology manufactured in Ontario to show that Canada’s progress in combating climate change can lower costs, create jobs, and benefit Canadians.

An Ontario Manufacturing Strategy

If the Ontario government wants to grow the manufacturing sector, there are three different philosophies it could take, ranging from highly interventionist to highly free market. Policymakers can think of these strategies on a continuum with three points, each composed of policies that assign different roles to government and other economic actors (Figure 3).

Figure 3: The continuum of strategies to revitalize Ontario’s comparative advantage in manufacturing

We argue that purely interventionist or purely neoliberal strategies should be avoided, as they are unlikely to create the conditions that Ontario manufacturing needs to thrive.

The neoliberal approach

At one end, a neoliberal strategy regarding manufacturing relies on a free-market type of governance. The guiding rationale is that the market provides all the necessary conditions and ingredients for industries to thrive. The role of economic policy is simply to ensure that Ontario has a business-friendly environment, through pro-market and pro-competition regulations and incentives. In practice, this typically means cutting regulations, particularly environmental and workplace safety regulations, and taxes, particularly corporate taxes.

While there is a need for well-considered tax and regulatory reform, this approach suffers from three problems. First, there is always another jurisdiction willing to slash regulations even further, and cut taxes even more. This race is unlikely to be won by Ontario, so why compete on those terms? Second, this approach is focused almost exclusively on attracting existing manufacturing firms to the province; it does little to create the conditions for the creation of domestic firms. And, third, the location of manufacturing plants is determined by far more than taxes and regulations; in the era of high-skilled manufacturing, access to talent is often the primary consideration.

Not all manufacturers are the same, or have the same needs, so the types of manufacturing attracted to a province or state will be a function of what that jurisdiction emphasizes. An emphasis on being a low-cost, rather than a high- skill jurisdiction, will attract the kind of firms driven by cost-saving strategies, such as labour and transport costs, supply coordination and logistics costs, and environmental regulations.[40] Attracting these types of manufacturers is often promoted by politicians and government officials as a reasonable strategy to revitalize manufacturing and stimulate domestic economic growth. But even if successful, it only repatriates assembly plants. It is hard to see how this kind of approach would be successful in Ontario, as those lower-skilled assembly tasks can be performed more cheaply in other jurisdictions, or through automation. So, this is unlikely to rebuild the industrial composition that characterized mid- twentieth century manufacturing, and to restore the demand for lower-skilled workers. What is more, it won’t meet the needs of economies committed to a net- zero future, nor will it create good research and development jobs. In short, the types of labour-intensive manufacturing plants common in the 1960s and 1970s aren’t coming back, no matter how many regulations are eliminated or taxes cut.

The interventionist approach

At the other pole is a more interventionist approach, involving a markedly different attitude toward the support of manufacturing. The state takes the role of being a key driver of innovation and economic growth. More than just fixing market failures or regulating market competition, as in the neoliberal approach, policymakers are tasked with designing and implementing a strong industrial policy to support and revitalize manufacturing industries. This involves selective policies that can differ depending on government priorities and agendas. As such, governments are the primary arbiters of investment decisions in human capital, infrastructure and productive capacity, industrial upgrading, and regional specialization.

We argue that an interventionist approach would be a dead-end too, as policymakers simply do not have the information or incentives to make such an approach work effectively. Policies are more likely to excel when tailored to local circumstances, and information is key in the development of customizable solutions.[41] However, whether it is private firms alone or the government which decides where and how to invest, no economic actor has complete information about the needs and challenges of local economies. Price signals can be used as an important factor in investment decisions, but due to their volatility and limitations (i.e., lagged price adjustments, and the possibility that they reflect monopolistic circumstances and other market failures), price signals are an inadequate tool to inform policy decisions. In short, a “government knows best” approach is unlikely to yield success.

The partnership approach as the path forward

We argue that Ontario policymakers should advance a nuanced strategy, one that lies between neoliberal and interventionist approaches. This involves acknowledgement that both private and public sector actors are essential to the identification of local strengths and limitations, as well as the needs of particular communities. Governments and private actors (such as firms, investment banks, local chambers of commerce, technical colleges and non-governmental organizations) come together, albeit in different capacities, to design and implement context-specific policies, programs, and initiatives to support manufacturing, especially in mid-sized communities that have been left behind from Ontario’s recent economic growth. Furthermore, collaborative, targeted policies are more likely to allow for the entrance of regions into specific technological fields, and the encouragement and revitalization of clusters and entrepreneurial initiatives that take advantage of local capabilities and address region-specific needs and challenges.[42]

Developing a partnership strategy to revitalize Ontario manufacturing

A partnership strategy to revitalize Ontario’s manufacturing should include tailored policies and customizable solutions for manufacturing industries and should be designed in collaboration, or at least in consultation, with diverse stakeholders. There are, however, policy prescriptions that should be considered across all selective policies.

Regional and communal differences must be taken into account: A partnership approach is uniquely positioned to provide valuable information on the strengths and weaknesses that each Ontarian region or community faces. The mobilization of diverse stakeholders better ensures the customization of policy and programs to local circumstances, which is a welcome advancement to counter the long trend of policy homogeneity across cities of all sizes in Ontario. Cities of different sizes are adopting general solutions that are widely accepted as appropriate, without the necessary adaptation or consideration of local variation.[43] Without long-lasting tailored solutions, isolated communities will likely continue to lose in the competition for mobile resources (such as regarding capital and workforce).

This paper recommends the following step:

- Stakeholder consultations should be organized with manufacturers in each region of the province to identify the barriers to growing production across sectors. Any approach needs to be specifically tailored towards the barriers each community faces. Without this information, innovation and economic development agencies cannot offer the support needed on the ground to support growth.[44] Any policy that takes regional differences into account in its design needs to be based on a clear understanding of local circumstances and barriers. This consultation should happen with colleges, unions, chambers of commerce and other representatives of local industry to better understand their perspectives.

Invest in the skills that will support Ontario’s advanced manufacturing sector: The revitalization and resilience of Ontario’s manufacturing requires a qualified workforce. As the province specializes in advanced manufacturing, the sector faces increasing labour shortages, with approximately 56% of manufacturing firms reporting hiring difficulties.[45] In partnership with industries and educational institutions, policymakers can design policies, programs, and investment initiatives that address this increasing challenge.

We recommend the following steps:

- Many policy efforts to build a qualified workforce in manufacturing overemphasize “hard”, technical skills. This overlooks the importance of “soft” or nontechnical skills, such as critical thinking, active learning, problem- solving, which are as important in advanced manufacturing as is being trained in STEM fields. These skills will be incentivized, taught, and practiced if curriculum development mainstreams soft skills in training and educational programs. Upcoming work by the Smart Prosperity Institute and Future Skills Centre finds that demand for soft skills will grow across a range of net-zero emissions sectors, making investments in these skills even more important for growing clean technology companies.

- The Canadian workforce is aging, and manufacturing is particularly vulnerable to this trend. The number of workers aged 55 and over in manufacturing increased 161% from 1996 to 2018, while the overall number of workers in the sector decreased.[46] Older and retiring workers are a valuable source of experience and know-how. Policymakers can develop mentorship programs that mobilize retirees and older workers to teach and mentor younger generations.

- Governments should support firm- sponsored training. Policymakers are unlikely to know the labour- related needs and challenges facing manufacturing firms and isolated economies. Supporting firm-sponsored education and training programs can result in initiatives being launched and implemented that are better attuned to local circumstances, which is critical in regional economic development.

Diversify the manufacturing workforce: Attracting and retaining a diverse workforce will not only make the manufacturing sector more inclusive and vibrant, it will also address current and potentially chronic skills shortages. Women, for example, remain an untapped resource, facing numerous structural barriers to participating fully in manufacturing. A study by Canadian Manufacturers & Exporters[47] indicates that the share of women’s participation in manufacturing has remained stagnant since the mid-1980s, and with a high likelihood of decline in the years to come, partly due to compositional changes in the sector.

In the last decades of the twentieth century, an increasing number of manufacturing firms, particularly those with labour- intensive manufacturing plants, moved operations offshore to locations with cheaper labour and laxer regulations.[48] Textiles and clothing, traditional manufacturing industries in Ontario, experienced significant declines in activity and employment.[49] Meanwhile, Ontario’s manufacturing specialized in transportation equipment, fabricated metals, and other high value manufacturing industries, which tend to be highly dependent on innovation and technological advancements to remain competitive.[50] These industries have tended to be more male dominated than the ones that were offshored. Merely training women and girls in STEM fields alone will likely yield unsatisfactory results.

To diversify the workforce, the focus should be on addressing the structural barriers that marginalize women and visible minorities. We recommend the following initiatives to address systemic challenges:

- Initiatives such as family-friendly workplace programs to address the issues of retainment, especially for working parents.

- Firm-level diversity committees to identify organizational patterns and procedures that pose barriers to career advancement and access to economic opportunities within the sector. These committees are also valuable to identify untapped potential in workers who are usually not considered for promotions.

- Pay transparency, and equal work/ equal pay policies to bridge gender and racial wage gaps. Data from the United States suggests that the gender pay gap tends to be particularly wide for some manufacturing jobs.[51]

- Affirmative actions to diversify the upper ranks of manufacturing firms. This is an important action as Canadian manufacturing is reported to be the only sector that did not see an increase in the representation of women on corporate boards from 2016 to 2017, remaining unchanged at approximately 13%.[52]

Policy prescriptions for a partnership approach to manufacturing

Ontario needs to consider regional differences, skills, and workforce diversity in developing a manufacturing strategy. The province also needs to account for the lifecycle of manufacturing firms, and to take a targeted approach to growing scale- ups, attracting foreign direct investment, and strengthening the manufacturing ecosystem. While this paper focuses on high-level strategies, there are specific policies the government should consider for a post-pandemic environment that fit within a partnership approach.

To aid the growth of manufacturing start-ups, the province should create an investor tax credit to generate more support for start-ups and to help the sector attract more risk capital.

A critical challenge for Ontario manufacturing start-ups and innovators, in emerging sectors like clean technology, is the attraction of risk capital. Risk capital is generally directed to high-risk, high- reward investments. To help attract this capital, the provincial government should create an investor tax credit specifically for Canadian clean technology manufacturers to leverage greater investment into a sector offering a wide range of economic and geopolitical benefits. Investor tax credits have a history of success for attracting investment into clean technology. The US Investment Tax Credit is expected to encourage $13.5 billion USD in investment into renewable energy between 2018 and 2022.[53] Newfoundland and Labrador and Prince Edward Island have investor tax credit programs for innovative manufacturing start-ups, a policy that Ontario could adopt to the benefit of provincial industry in support of attracting higher risk capital to the province.[54] Part of the value of an investor tax credit is that it typically involves an application process, allowing governments to decide which companies should receive support based on these applications. This enables governments to be more selective and strategic about support, which can improve targeting and potentially improve alignment between private sector supports and policy objectives. Additionally, this approach allows governments to place larger investments in a fewer number of companies, rather than providing financial and fiscal support too small to make a difference.

To attract foreign direct investment and aid the scale-up of domestic companies, the provincial government should institute deep, targeted, time-limited, corporate tax cuts, for manufacturing subsectors deemed to be of strategic importance. This is an approach more likely to yield satisfactory results than reducing the overall corporate tax rate for manufacturers.

Manufacturers in Ontario are eligible for the Manufacturing and Processing Tax Credit (M&P Tax Credit) which effectively reduces their provincial corporate tax rate from 11.5% to 10%.[55] A viable further option is to reduce the effective corporate tax rate on manufacturers by making the M&P tax credit more generous, with the aim that this helps attract and retain manufacturers in the province. But for any incentive to work, it must change behaviour, and there is no guarantee that manufacturers will change their location decisions in response to a lower tax rate.

A study by Lawless et. al.[56] provides evidence that manufacturers are sensitive to the corporate tax rate when making location decisions. They note, however, that the impact of tax rates is non- linear, suggesting that a small change in corporate tax rates is likely to have little impact; any tax reduction would need to be substantial in order to alter location decisions. Given that firms also pay federal corporate tax, simply reducing the provincial manufacturing corporate tax rate from 10% to, say, 9% is unlikely to drive significant new investment, while simultaneously reducing tax receipts from those firms by one-tenth.

Instead of small manufacturing sector tax cuts, the Ontario government should consider deep, time-limited corporate tax cuts aimed at manufacturing subsectors where the province believes there to be growth opportunities. One such example is the federal government’s Budget 2021 initiative that reduces the corporate tax rates on manufacturers of zero-emissions technologies from 15% to 7.5%.[57] This tax cut is more likely to drive investment decisions since it is large and is of relatively low-risk and low-cost to the government, as few existing Ontario manufacturers are currently eligible for the lower tax rate. If firms decide not to make zero-emissions technology manufacturing investments in Ontario, the lower tax rates will have minimal costs to the treasury. It is also time- limited, phasing out over a decade, to avoid a permanent erosion of the tax base.

At a minimum, the Ontario government should halve the corporate tax rates on zero-emissions manufacturers from 10% to 5%, to take advantage of the non- linear investment response to tax rates. It should also consider extending this approach to other technologies where the province believes it could have a comparative advantage.

To strengthen Ontario’s manufacturing ecosystem as a whole, the province should translate successful policies from both the Manufacturing USA Institute model and NextGeneration Innovation Supercluster into provincial policy.

These two models represent different options for public-private sector collaboration. The Manufacturing USA model, launched in 2012, created 16 distinct institutes with unique ways to create regional innovation hubs that are led by industry, academic, and public sector partnerships.[58] The Advanced Manufacturing Supercluster is an industry- led consortium with a focus on connecting local and national industrial stakeholders.[59] Both models entail opportunities to advance public-private, partnership-driven policy that benefits Canadian manufacturers in areas of data management, intellectual property (IP), and the building of networks with small and medium enterprises (SMEs). Provincial policymakers should consider reproducing these policies in Ontario. However, it is too early to draw conclusions about policy successes from preliminary reviews of either initiative. Reviews of the Manufacturing USA Initiative from both the US Government Accountability Office and Deloitte suggested that elements of the program had been successful (notably, building industry networks of best practices and helping connect suppliers), but the lack of clarity around how to measure economic success in the near-term makes it difficult to identify what has and has not worked well so far.[60] It is therefore too soon to determine which elements of the initiative are yielding the greatest success for US manufacturing. Similarly, a 2020 preliminary review of the Innovation Superclusters Initiative suggested that it was still too early to point to successful program elements.[61] As it becomes clearer whether strategies for IP, data management and building networks for SMEs are successful for achieving outcomes that are desirable for Ontario’s manufacturing sector, the provincial government should consider adopting these steps as official policy. This would support a partnership strategy, since it would build off industry successes experienced elsewhere.

Conclusion: There is No Time to Waste

This paper addresses a straightforward question: “Should the Ontario government specifically try to create growth in the manufacturing sector, or should it simply focus on creating the best possible environment for business, and be indifferent to which sectors grow?” We argue that manufacturing does matter for Ontario. This key sector can help generate economic opportunities outside the Toronto and Ottawa regions, spur local economic development, and offer a host of positive economic benefits. And it can also build the clean technologies of today and tomorrow.

The provincial government should engage more with industry through supportive policies and partnerships to ensure that Ontario remains Canada’s manufacturing hub. This paper notes that regional and local differences need to be taken into account in designing policies, beginning with addressing the barriers companies face in different communities. The importance of skills training for workers cannot be understated, with specific programs needed to upgrade soft skills in the workforce, and to address the growing number of impending retirements in the sector. And the manufacturing workforce needs to attract a wider, more diverse group of employees; something that can be supported through better-designed workplace programming.

Mike Moffatt is the Senior Director of Policy at the Smart Prosperity Institute and an Assistant Professor in the Business, Economics, and Public Policy group at Ivey Business School, Western University. In 2017, Mike was the Chief Innovation Fellow for the Government of Canada, advising Deputy Ministers on innovation policy and emerging trends.

Aline Coutinho is a postdoctoral research fellow at the Smart Prosperity Institute, where she is developing a policy-oriented research agenda to improve inclusivity in the green economy. As an economic sociologist, Aline works on identifying and explaining the systemic barriers and mechanisms that keep women, racialized minorities, and other marginalized groups from fully participating in entrepreneurial ecosystems and in the labour market.

John McNally is a Senior Research Associate and a Program Lead for Clean Growth Policy at the Smart Prosperity Institute. John leads a research team focused on improving well-being for Canadian communities, supporting economic growth and combatting climate change.

NOTES

[1] E. Cleave et al. (2019), “Manufacturing change and policy response in the contemporary economic landscape: How cities in Ontario, Canada, understand and plan for manufacturing,” Regional Studies, Regional Science, 6(1), 469–495. https://doi.org/10.1080/21681376.2019.1668292 ; G.P. Green & L. Sanchez (2007), “Does Manufacturing Still Matter?,” Population Research and Policy Review, 26(5), 529–551, https://doi.org/10.1007/s11113-007-9043-8; I. Tecu (2013), The Location of Industrial Innovation: Does Manufacturing Matter?, US Census Bureau Center for Economic Studies.

[2] D. Baker & T. Lee (1993), Employment multipliers in the U.S. economy, Economic Policy Institute, https://files.epi.org/2014/working-paper-107.pdf

[3] B.-Å Lundvall (2016), “From manufacturing nostalgia to a strategy for economic transformation,” Economia e Politica Industriale, 43(3), 265–271, https://doi.org/10.1007/s40812-016-0034-9 ; R.K. Pandian (2017), “Does Manufacturing Matter for Economic Growth in the Era of Globalization?,” Social Forces, 95(3), 909–940, https://doi.org/10.1093/sf/sow095

[4] A. Berube (2019), Small and midsized legacy communities: Trends, assets, and principles for action (Metropolitan Policy Program), Brookings Institute, https://www.brookings.edu/wp-content/uploads/2019/11/201911_BrookingsMetro_Legacy-communities_Berube_Final.pdf ; M. Moffatt (2018), “How Ontario’s two-speed economy is making inequality worse,” TVO Politics. https://www.tvo.org/article/how-ontarios-two-speed-economy-is-making-inequality-worse

[5] D. Breznitz (2021), Innovation in real places: strategies for prosperity in an unforgiving world, Oxford: Oxford University Press.

[6] M. Oschinski & K. Chan (2014), Ontario Made: Rethinking Manufacturing in the 21st Century: Full Report, Mowat Centre for Policy Innovation, University of Toronto.

[7] OECD (2019), “The decline of the manufacturing sector: Percentage change in total employment within industry for selected OECD countries, 1995 to 2015,” In OECD Employment Outlook 2019: The Future of Work, OECD Publishing, Paris, https://doi.org/10.1787/cc51a592-en.

[8] A. Bernard (2009), Trends in manufacturing employment (Perspectives on Labour and Income), Statistics Canada, https://www150.statcan.gc.ca/n1/pub/75-001-x/2009102/article/10788-eng.htm

[9] M. Moffatt (2021), The Big Shift: Changes in Canadian Manufacturing Employment (2003 to 2018), Future Skills Centre.

[10] Moffatt (2021), The Big Shift.

[11] Statistics Canada (2021), Table 14-10-0023-01, Labour force characteristics by industry, annual (X 1,000), https://doi.org/10.25318/1410002301-eng

[12] Statistics Canada (2021), Table 36-10-0489-05 Total compensation per job, by NAICS industry, https://doi.org/10.25318/3610048901-eng

[13] Pandian (2017) “Does Manufacturing Matter for Economic Growth in the Era of Globalization”.

[14] B. Eisen & J. Emes (2020), Economic Performance in Ontario CMAs: A National Comparative Perspective (Fraser Research Bulletin), Fraser Institute, https://www.fraserinstitute.org/sites/default/files/economic-performance-in-ontario-cmas.pdf

[15] M. Moffatt (2018), “How Ontario’s two-speed economy is making inequality worse.”

[16] E. Moretti (2012), The New Geography of Jobs, Houghton Mifflin Harcourt, Newfoundland and Labrador, (2021), “What is the Direct equity tax credit program?,” Province of Newfoundland and Labrador, https://www.gov.nl.ca/fin/faq/tax-program/#4

[17] M. Moffatt, H. Rasmussen & D. Watters (2017), Towards an inclusive innovative Canada, Canada2020, https://canada2020.ca/wp-content/uploads/2017/02/020317-EN-FULL-FINAL.pdf

[18] Berube (2019), Small and midsized legacy communities.

[19] A CMA is a “Census Metropolitan Area”. Toronto CMA includes the City of Toronto and surrounding cities such as Brampton, Markham, Mississauga and Vaughan.

[20] Moffatt (2021), The Big Shift.

[21] Moffatt (2021), The Big Shift.

[22] Specifically 65 Census Metropolitan Areas (CMAs) and Census Agglomerations (CAs)

[23] Moffatt (2021), The Big Shift.

[24] Moffatt (2021), The Big Shift.

[25] Moffatt (2021), The Big Shift.

[26] See L. Jones (1976), “The Measurement of Hirschmanian Linkages,” The Quarterly Journal of Economics, 90(2), 323–333, https://doi.org/10.2307/1884635

[27] J. Bivens (2019), Updated employment multipliers for the U.S. economy, Economic Policy Institute, https://www.epi.org/publication/updated-employment-multipliers-for-the-u-s-economy/ ; Pandian (2017) “Does Manufacturing Matter for Economic Growth in the Era of Globalization”.

[28] Pandian (2017).

[29] B.-Å Lundvall (2016), “From manufacturing nostalgia to a strategy for economic transformation,” Economia e Politica Industriale, 43(3), 265–271, https://doi.org/10.1007/s40812-016-0034-9 ; Pandian, (2017).

[30] A. Andreoni & M. Gregory (2013), “Why and how does manufacturing still matter: Old rationales, new realities,” Revue d’économie Industrielle, 144, 21-57 ; Lundvall (2016), From manufacturing nostalgia to a strategy for economic transformation.”

[31] D. Bailey & L. De Propris (2014), “Manufacturing reshoring and its limits: The UK automotive case,” Cambridge Journal of Regions, Economy and Society, 7(3), 379–395, https://doi.org/10.1093/cjres/rsu019

[32] S. Kinkel (2014), “Future and impact of backshoring—Some conclusions from 15 years of research on German practices,” Journal of Purchasing and Supply Management, 20(1), 63–65, https://doi.org/10.1016/j.pursup.2014.01.005

[33] Dun & Bradstreet (2021), The Suez Canal: Looking Beyond the Surface to Access the Full Economic Impact, https://www.dnb.com/content/dam/english/dnb-solutions/the-suez-canal-looking-beyond-the-surface-to-access-the-full-economic-impact.pdf

[34] W.L. Tate et al. (2014), “Global competitive conditions driving the manufacturing location decision,” Business Horizons, 57(3), 381–390, https://doi.org/10.1016/j.bushor.2013.12.010

[35] New Climate Institute & Climate Analytics (2021), “The Climate Action Tracker,” https://climateactiontracker.org/

[36] M. Brownlee et al., (2017), “Why clean innovation is critical to Canada’s economy and how we get it right,” Smart Prosperity Institute, https://institute.smartprosperity.ca/sites/default/files/cleaninnovationinstitutereport-final.pdf

[37] Breznitz (2021), Innovation in real places.

[38] L. Jin et al. (2021), “Driving a g reen future: A retrospective review of China’s electric vehicle development and outlook for the future,” The International Council on Clean Transportation, https://theicct.org/publications/china-green-future-ev-jan2021

[39] J. Biden (2021), Marketwatch (2021), “Biden’s first speech to Congress: full text,” Marketwatch, https://www.marketwatch.com/story/bidens-first-speech-to-congress-full-text-11619659158

[40] Bailey & De Propis (2014) “Manufacturing reshoring and its limits”; Kinkel (2014), “Future and impact of backshoring.”

[41] B. Haley (2016), “Getting the Institutions Right: Designing the Public Sector to Promote Clean Innovation,” Canadian Public Policy, 42(S1), S54–S66, https://doi.org/10.3138/cpp.2016-051

[42] Lundvall (2016), “From manufacturing nostalgia to a strategy for economic transformation.”

[43] E. Cleave et al. (2019), “Manufacturing change and policy response in the contemporary economic landscape: How cities in Ontario, Canada, understand and plan for manufacturing,” Regional Studies, Regional Science, 6(1), 469–495. https://doi.org/10.1080/21681376.2019.1668292

[44] Breznitz (2021), Innovation in real places.

[45] M. Cocolakis-Wormstall (2018), Labour shortage: Here to stay, Business Development Bank of Canada, https://www.bdc.ca/en/documents/analysis_research/labour-shortage.pdf

[46] B. Ouellet-Léveillé & A. & Milan (2019), Results from the 2016 Census: Occupations with older workers (Insights on Canadian Society), Statistics Canada, https://www150.statcan.gc.ca/n1/en/pub/75-006-x/2019001/article/00011-eng.pdf?st=Ias44q8l

[47] Canadian Manufacturers & Exporters (2017), Untapped potential: Attracting and engaging women in Canadian manufacturing, https://cme-mec.ca/wp-content/uploads/2018/11/CME-WIM-Summary-Report.pdf

[48] G. Arku, E. Cleave & M. Easton (2020), “Geographic differences in the distribution of manufacturing firms in Ontario, Canada,” Area 52(3), 634-645, https://doi.org/10.1111/area.12615 ; L. Bourne, J.N.H. Britton & D. Leslie (2011), “The greater Toronto region: The challenges of economic restructuring, social diversity and globalization”, in L.S. Bourne, L., Britton, J. N. H. N., & Leslie, D. (2011). In L. S. Bourne, T. Hutton, R. G. Shearmur, & J. Simmons (Eds.), Canadian urban regions: Trajectories of growth and change (pp. 236–268), Oxford: Oxford University Press ; M. Oschinski & K. Chan (2014), Ontario Made: Rethinking Manufacturing in the 21st Century: Full Report, Mowat Centre for Policy Innovation, University of Toronto.

[49] B. Ouellet-Léveillé & A. & Milan (2019), Results from the 2016 Census: Occupations with older workers (Insights on Canadian Society), Statistics Canada, https://www150.statcan.gc.ca/n1/en/pub/75-006-x/2019001/article/00011-eng.pdf?st=Ias44q8l

[50] W. Gu, & J. Li (2017), Multinationals and Reallocation: Productivity Growth in the Canadian Manufacturing Sector (Analytical Studies Branch Research Paper Series), Statistics Canada, https://www150.statcan.gc.ca/n1/en/pub/11f0019m/11f0019m2017398-eng.pdf?st=_qnnFwkM

[51] Bloomberg (2017), “Equal Pay Day: The Gender Pay Gap Persists Among Millennials,” Industry Week. https://www.industryweek.com/talent/compensation-strategies/article/22006852/equal-pay-day-the-genderpay-gap-persists-among-millennials#:~:text=Gender%20Gap%20in%20Manufacturing&text=The%202017%20IndustryWeek%20Salary%20Survey,what%20their%20male%20counterparts%20earned.

[52] Statistics Canada (2020), Representation of women on boards of directors, 2017, https://www150.statcan.gc.ca/n1/daily-quotidien/200128/dq200128b-eng.htm

[53] J. Goldman (2021), “Budget 2021: the US tax code and the race for the clean energy future. Smart Prosperity Institute,” https://institute.smartprosperity.ca/USTaxCode

[54] Newfoundland and Labrador (2021), “What is the Direct equity tax credit program?,” Province of Newfoundland and Labrador, https://www.gov.nl.ca/fin/faq/tax-program/#4 ; InnovationPEI (2021), “Share purchase tax credit,” InnovationPEI, https://www.innovationpei.com/sharepurchasetaxcredit.

[55] M. Moffatt (2021), Budget 2021: How would a corporate tax cut for cleantech manufacturers work – and what could it accomplish?, Smart Prosperity Institute, https://institute.smartprosperity.ca/CleantechTaxCut

[56] M. Lawless, D. Mccoy, E. Morgenroth & C. O’Toole (2017), “Corporate Tax and Location Choice for Multinational Firms,” Applied Economics. https://doi.org/10.1080/00036846.2017.1412078

[57] Smart Prosperity Institute (2021), An ambitious budget for a green, resilient recovery https://institute.smartprosperity.ca/Budget2021

[58] Manufacturing USA (2021), “Manufacturing USA,” https://www.manufacturingusa.com/

[59] ISED (2021), “Innovation Superclusters: Program Guide,” Innovation, Science and Economic Development Canada. https://clustercollaboration.eu/sites/default/files/international_cooperation/sprclstr-prgrm-gd-v2-en.pdf

[60] Deloitte (2017), “Manufacturing USA: A third-party evaluation of program design and progress,” Deloitte, https://www2.deloitte.com/content/dam/Deloitte/us/Documents/manufacturing/us-mfg-manufacturing-USA-program-and-process.pdf ; Government Accountability Office (GAO), United States (2019), “Advanced manufacturing: Innovation Institutes Have Demonstrated Initial Accomplishments, but Challenges Remain in Measuring Performance and Ensuring Sustainability,” United States Government Accountability Office, Reports to Congressional Committees, GAO-19-409, https://www.gao.gov/assets/gao-19-409.pdf

[61] Parliamentary Budget Office (PBO) (2020), The innovation superclusters initiative: A preliminary analysis, Office of the Parliamentary Budget Officer, https://www.pbo-dpb.gc.ca/web/default/files/Documents/Reports/RP-2021-024-S/RP-2021-024-S_en.pdf